Real-World Examples and Industry Moves

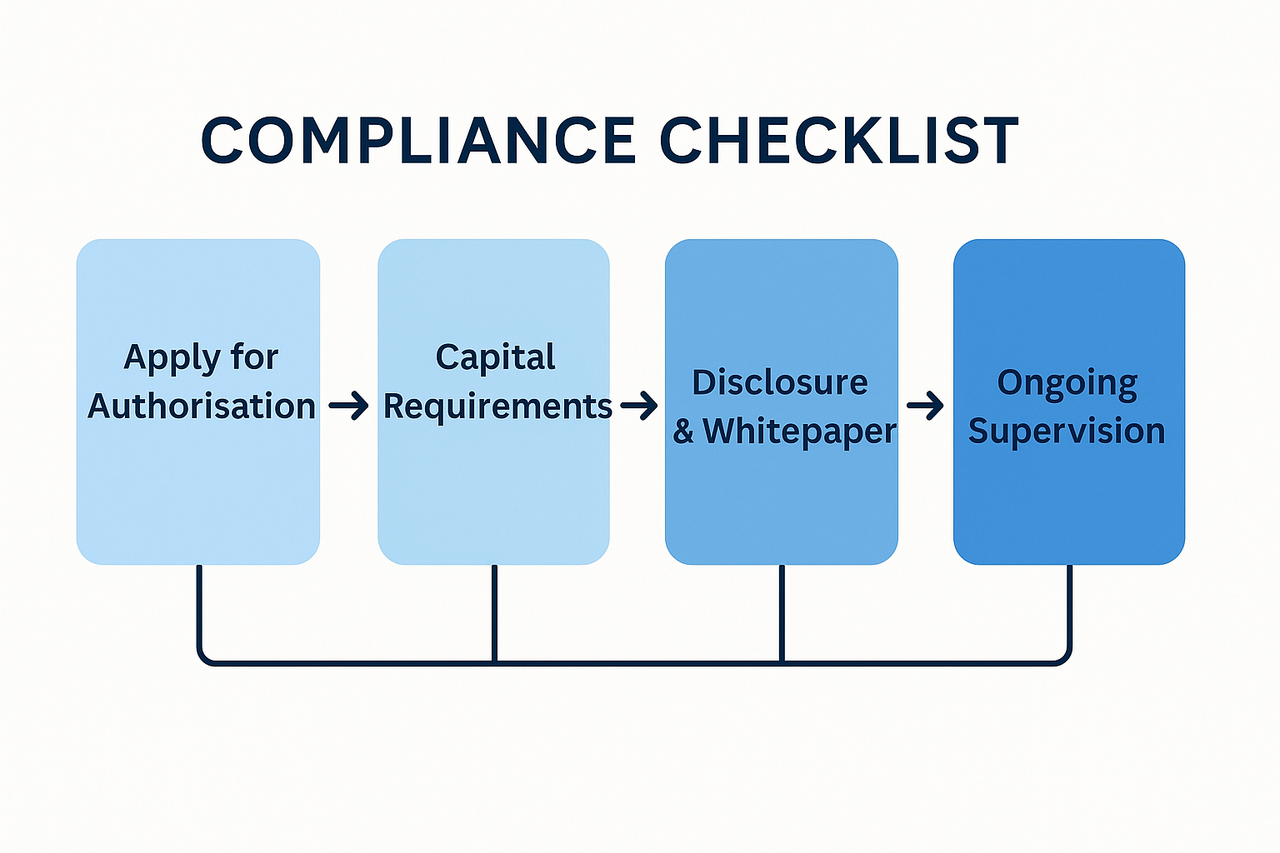

This module details the operational and licensing requirements for entities issuing ARTs or EMTs under MiCA. It examines the authorisation process, capital adequacy standards, governance rules, disclosure obligations, and ongoing supervision. The section also highlights how issuers must structure their operations to meet regulatory expectations.

Introduction

The entry into force of the Markets in Crypto-Assets Regulation (MiCA) has begun to reshape the European stablecoin market. Its effects are visible not just in regulatory filings but in the strategic moves of major issuers, financial institutions, and crypto-asset service providers. This module examines how the rules have influenced market composition, the operational responses of compliant issuers, and the wider restructuring of the digital asset ecosystem in anticipation of, or reaction to, MiCA.

Understanding these industry responses offers a practical lens on how a theoretical regulatory framework translates into concrete market behaviour. The case studies outlined here illustrate the diversity of approaches to compliance, the strategic positioning of firms for competitive advantage, and the challenges encountered along the way.

Circle and the EMI Model for EMT Issuance

In July 2024, Circle became the first non-bank firm to secure an Electronic Money Institution (EMI) licence under the MiCA framework, issued by the French Prudential Supervision and Resolution Authority (ACPR). This licence enabled Circle to offer its USDC and euro-denominated EUROC as fully compliant E-Money Tokens (EMTs) across the European Union.

Securing an EMI licence under MiCA is not a symbolic gesture; it requires demonstrating robust capital adequacy, liquidity management, and governance arrangements. Circle’s reserve structure was adapted to meet MiCA’s strict 1:1 asset-backing and segregation rules, with all reserves held in regulated financial institutions within the EU. Daily reconciliations and public attestations became standard operating procedures, and redemption processes were re-engineered to allow on-demand conversions at par value for euro and US dollar holdings.

Circle’s compliance model also included embedding MiCA-aligned disclosures into its public white papers, detailing risk factors such as potential disruptions in fiat banking rails and exposure to changes in monetary policy. Its decision to locate primary issuance under a French licence allowed it to benefit from EU passporting, enabling the circulation of its EMTs across all member states without seeking separate approvals in each jurisdiction.

Société Générale’s EURCV: A Bank-Led ART

Société Générale-Forge, the digital assets division of the French banking group, launched EURCV in December 2023. EURCV is an Asset-Referenced Token (ART) that maintains value by referencing a diversified portfolio comprising euro-denominated sovereign bonds, cash equivalents, and short-term bank deposits. This basket composition, combined with the bank’s role as issuer, positioned EURCV as one of the first fully bank-backed ARTs aligned with MiCA’s provisions.

Under MiCA, EURCV required authorisation as an ART, necessitating the submission of a comprehensive white paper to the French regulator outlining reserve management methodology, asset valuation procedures, redemption rights, and governance structures. The reserve assets are subject to quarterly independent audits, with results published on the bank’s digital asset portal to satisfy MiCA’s transparency requirements.

The issuance of EURCV was part of a broader strategy by Société Générale to integrate tokenised financial products into its service offerings, bridging traditional wholesale banking with decentralised finance (DeFi) applications. By launching a regulated ART, the bank signalled its intent to capture market share in the institutional DeFi space, providing a compliant euro-based collateral instrument for lending protocols, tokenised securities settlement, and cross-border trade finance.

Banking Circle’s EURI: Cross-Border Payments Focus

Banking Circle, a Luxembourg-based bank specialising in cross-border payment solutions, introduced EURI in mid-2024 as a euro-pegged EMT under MiCA. Unlike retail-focused stablecoins, EURI was designed primarily for institutional settlement between banking and fintech partners, with a strong emphasis on transaction speed and cost efficiency in multi-currency corridors.

The firm’s MiCA compliance strategy involved integrating its EMT issuance platform directly with existing correspondent banking infrastructure, enabling instant settlement between EURI and other fiat currencies supported by partner institutions. Banking Circle also established liquidity pools to facilitate 24/7 redemptions, a capability essential for a token targeted at financial institutions operating across different time zones.

EURI’s adoption among European payment providers has been aided by its full MiCA alignment, giving counterparties confidence in its redemption guarantees, reserve quality, and governance oversight. This case demonstrates how MiCA-compliant stablecoins can be embedded into existing financial infrastructure without necessarily targeting retail end-users.

Exchange Responses: Delistings and Re-Listings

As the MiCA deadlines approached, major crypto exchanges adjusted their offerings to ensure compliance. In October 2024, Coinbase announced it would delist several non-compliant stablecoins for EU customers, citing the inability of their issuers to meet MiCA’s reserve, licensing, or disclosure requirements. This pre-emptive move reflected the exchange’s assessment of legal risk and its intention to maintain uninterrupted EU operations.

Some exchanges adopted a phased re-listing strategy, reintroducing compliant tokens once issuers had obtained the necessary authorisations. Binance, for example, initially restricted access to certain dollar-pegged stablecoins for EU users but later restored them in limited jurisdictions following issuer compliance upgrades. These adjustments underscored the role of exchanges as critical gatekeepers in enforcing regulatory alignment within the trading environment.

The Strategic Rise of Euro-Denominated Stablecoins

MiCA has accelerated interest in euro-denominated stablecoins, partly due to regulatory incentives and partly because of the European Central Bank’s stated position that such instruments could strengthen the euro’s role in global payments. With dollar-pegged tokens facing stricter scrutiny, issuers have sought to diversify their product lines with euro-based offerings to secure market relevance in the EU.

Several fintech start-ups, alongside established payment institutions, have filed applications to issue EMTs pegged to the euro, anticipating demand from merchants, payment processors, and cross-border e-commerce platforms. The availability of compliant euro-pegged stablecoins is expected to complement the eventual rollout of a digital euro, potentially creating a layered ecosystem where private and public digital money coexist.

Compliance Costs and Market Consolidation

The operational costs of MiCA compliance are significant, especially for smaller issuers. Meeting reserve audit standards, establishing EU-based custodial arrangements, and producing regulator-approved white papers require substantial investment in legal, accounting, and operational resources.

For some issuers, these costs have prompted strategic exits from the EU market. Others have sought partnerships or acquisitions to gain access to existing MiCA-authorised infrastructure rather than building their own from scratch. This trend points toward a likely consolidation of the stablecoin market in Europe, with a smaller number of well-capitalised, fully compliant issuers dominating circulation.

Impact on DeFi Integration

The alignment of certain stablecoins with MiCA has opened new pathways for regulated DeFi participation. Compliant EMTs and ARTs have begun to appear as collateral in decentralised lending protocols that cater to institutional participants, such as permissioned liquidity pools restricted to verified entities.

The ability to integrate MiCA-compliant stablecoins into on-chain financial products while preserving legal clarity has attracted interest from traditional asset managers seeking to test tokenised yield strategies. However, the permissioning and KYC requirements embedded in these tokens mean they cannot circulate freely in all DeFi environments, potentially limiting their utility in fully open, permissionless protocols.

Global Issuers and Regulatory Arbitrage Concerns

One unresolved challenge is the treatment of global stablecoins issued both inside and outside the EU. Some issuers operate dual structures—offering a MiCA-compliant version for EU customers while maintaining an unregulated counterpart for other jurisdictions. Critics argue that such arrangements may undermine MiCA’s goals, particularly if tokens remain fungible across regulated and unregulated environments, allowing risks to flow into the EU market indirectly.

EU regulators have acknowledged the risk of regulatory arbitrage and indicated that supervisory focus will include monitoring the fungibility of compliant and non-compliant versions of the same token. The EBA has the authority to impose additional controls on significant tokens if they detect systemic vulnerabilities linked to cross-border flows.

Industry Outlook

The implementation of MiCA has set a new benchmark for stablecoin regulation globally, and other jurisdictions are observing the EU’s approach closely. Early signs suggest that MiCA compliance can be a competitive advantage, especially for issuers targeting institutional adoption.

Over the next 12–18 months, the European stablecoin landscape is expected to stabilise into a smaller group of highly trusted issuers offering both euro- and dollar-denominated tokens. Integration with regulated DeFi platforms, cross-border payment networks, and potentially the digital euro will likely define the next phase of market development.

Issuers that have embraced MiCA’s transparency, reserve, and redemption requirements are positioning themselves not just for survival in the EU market, but for leadership in the global conversation about the future of regulated digital money.