Wang Linpeng, the owner of Juran Home, has jumped off a building for the sixth time this year.

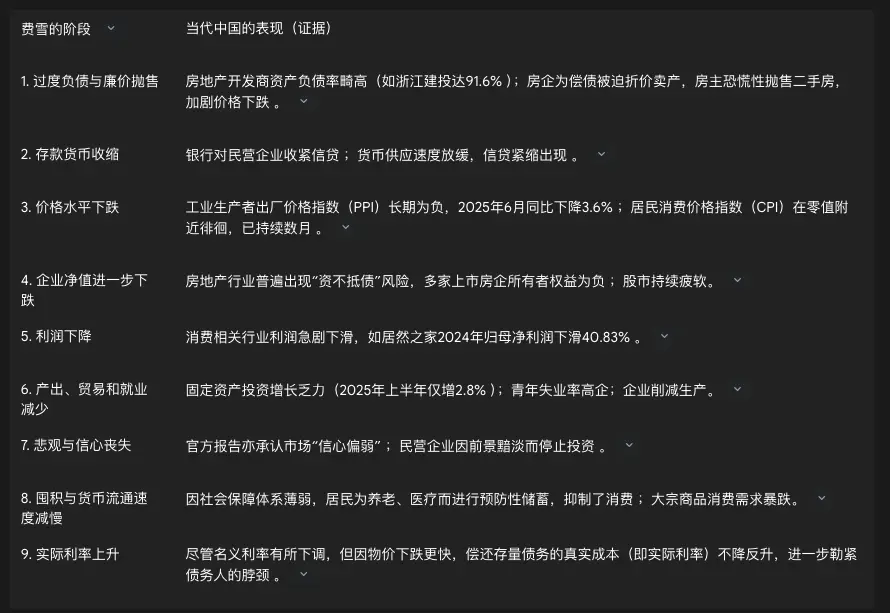

I remembered a saying in the financial world: deflation is scarier than inflation, deflation can kill.

In 1933, after experiencing the Great Depression and personal bankruptcy, Irving Fisher proposed the "Debt-Deflation Theory": when prices continue to fall, the real burden of debt sharply increases. Because the purchasing power of money strengthens, borrowers need to use more "valuable" money to repay their debts, leading to a wave of bankruptcies, corporate liquidations, and a surge in unemployment

View Original