$BTC view remains unchanged, although the big coin has given a short-term rebound, I personally still believe the trend has not reversed. This can only be called a B-wave rebound. Here we continue to wait; currently, looking at the low point of the day before yesterday, the 111800 line is still not the bottom. At least we need to wait for a second dip that does not break to form a bottom for long positions to have the opportunity to break higher. This time, the big coin's ABC three-wave pullback has nothing to do with the month; it's just that the market data has reached here. It is not about

View OriginalBrotherLinTalksAboutK-line

Graduated from Shanghai University of Finance and Economics, formerly employed at Red Shirt Capital, with eight years of market experience and rich practical knowledge. Has done considerable research on gold, crude oil, and Crypto Assets, and is adept at trend interpretation and short-term layout!

BrotherLinTalksAboutK-line

On Wednesday, Ether continued to rise strongly, can BTC keep up the pace and continue to attack?

Last night, the suggestion to short during the rebound backfired, brothers. The BTC strategy is fine, but the Ether movement is too crazy, it's completely out of control with the aggressive ups and downs. To be honest, it's a bit overwhelming for people. I got stopped out on my short at 4437 for Ether last night, and after the stop loss was triggered above 4500, I didn't dare to chase because the position was too high, regrettably missing out on the subsequent upward movement...

Currently, BTC has

View OriginalLast night, the suggestion to short during the rebound backfired, brothers. The BTC strategy is fine, but the Ether movement is too crazy, it's completely out of control with the aggressive ups and downs. To be honest, it's a bit overwhelming for people. I got stopped out on my short at 4437 for Ether last night, and after the stop loss was triggered above 4500, I didn't dare to chase because the position was too high, regrettably missing out on the subsequent upward movement...

Currently, BTC has

- Reward

- like

- Comment

- Repost

- Share

On Friday, Ethereum precisely reached the 4000 mark, and the long order took off directly!

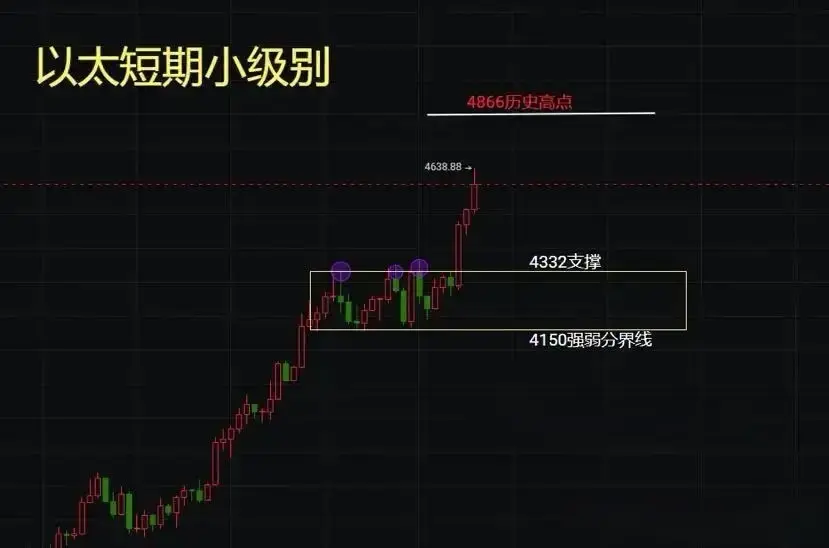

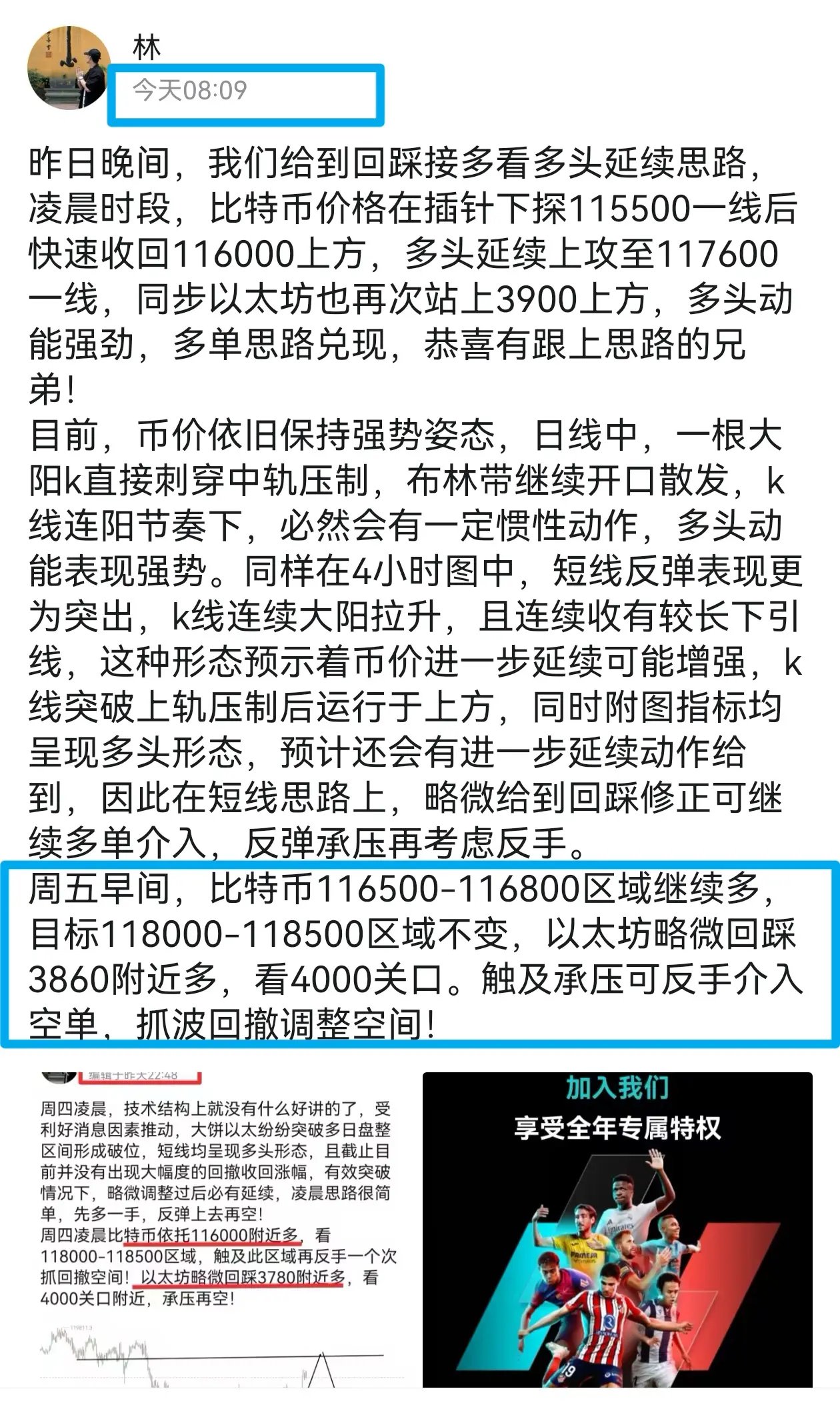

In the morning, we provided a very clear idea, a slight pullback correction would be a long order, directly aiming for a bullish outlook near the 4000 mark. Currently, Ethereum is strongly rallying around the 4011 level, and this wave has directly filled us up!

Regarding Bitcoin, the bullish target is set in the 118000-118500 range. Although it hasn't reached the target area yet, it is worth noting that after breaking the resistance yesterday, the price has been oscillating and adjusting above without a

View OriginalIn the morning, we provided a very clear idea, a slight pullback correction would be a long order, directly aiming for a bullish outlook near the 4000 mark. Currently, Ethereum is strongly rallying around the 4011 level, and this wave has directly filled us up!

Regarding Bitcoin, the bullish target is set in the 118000-118500 range. Although it hasn't reached the target area yet, it is worth noting that after breaking the resistance yesterday, the price has been oscillating and adjusting above without a

- Reward

- like

- Comment

- Repost

- Share

On Wednesday, the market fluctuated throughout the day but still failed to break out, with limited volatility. The small-scale patterns have been pulling for a long time without any clear signals appearing. However, if we zoom out to the weekly chart, it is not difficult to find that BTC has shown a stage top signal after reaching a new high, and has since been in a weak consolidation. If a strong bullish reversal does not occur this week, there is a high likelihood that the dip will continue next week. In the auxiliary indicators, MACD is currently showing a high-level divergence, and once a

View Original

- Reward

- 2

- 2

- Repost

- Share

BrotherLinTalksAboutK-line :

:

Just go for it 💪View More

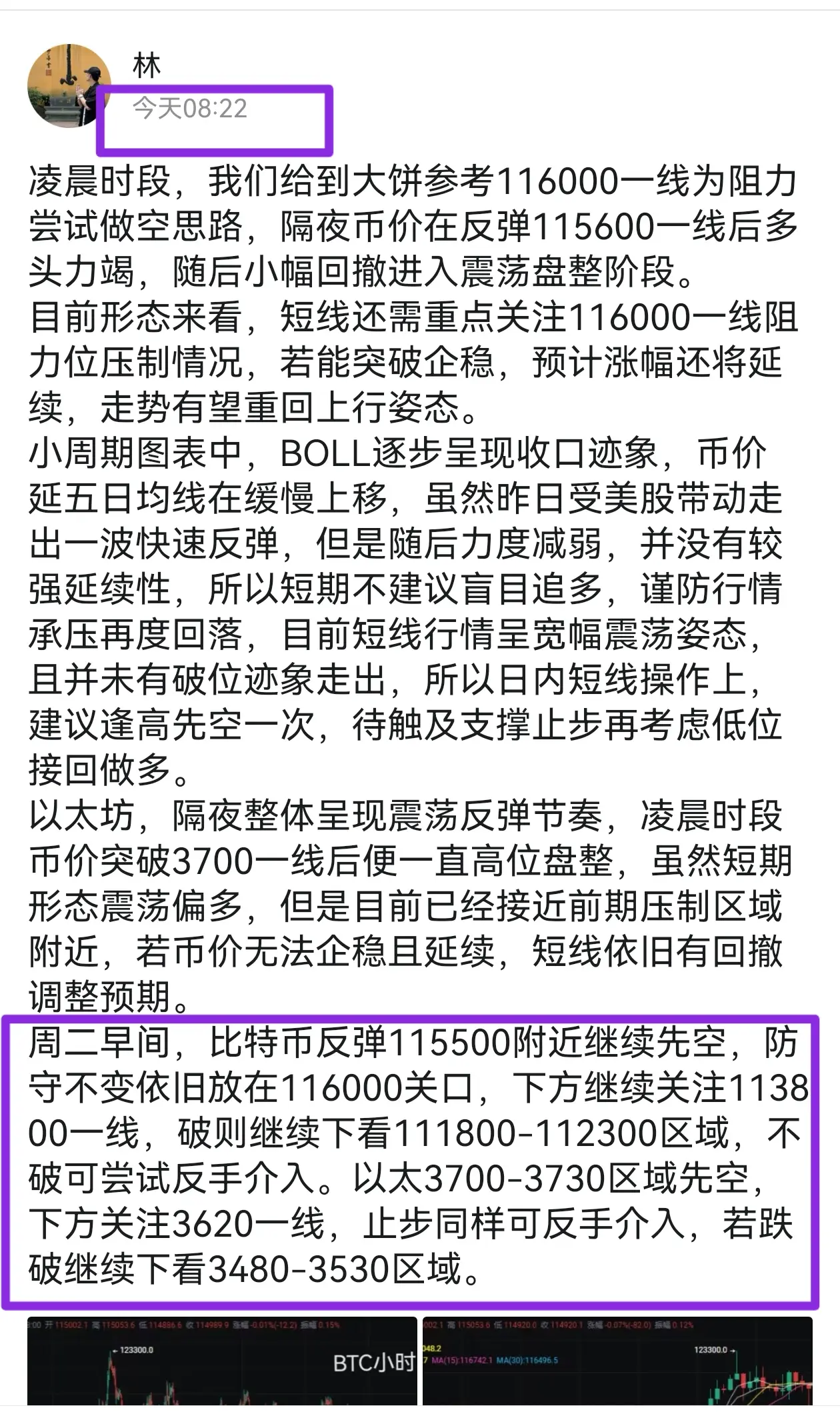

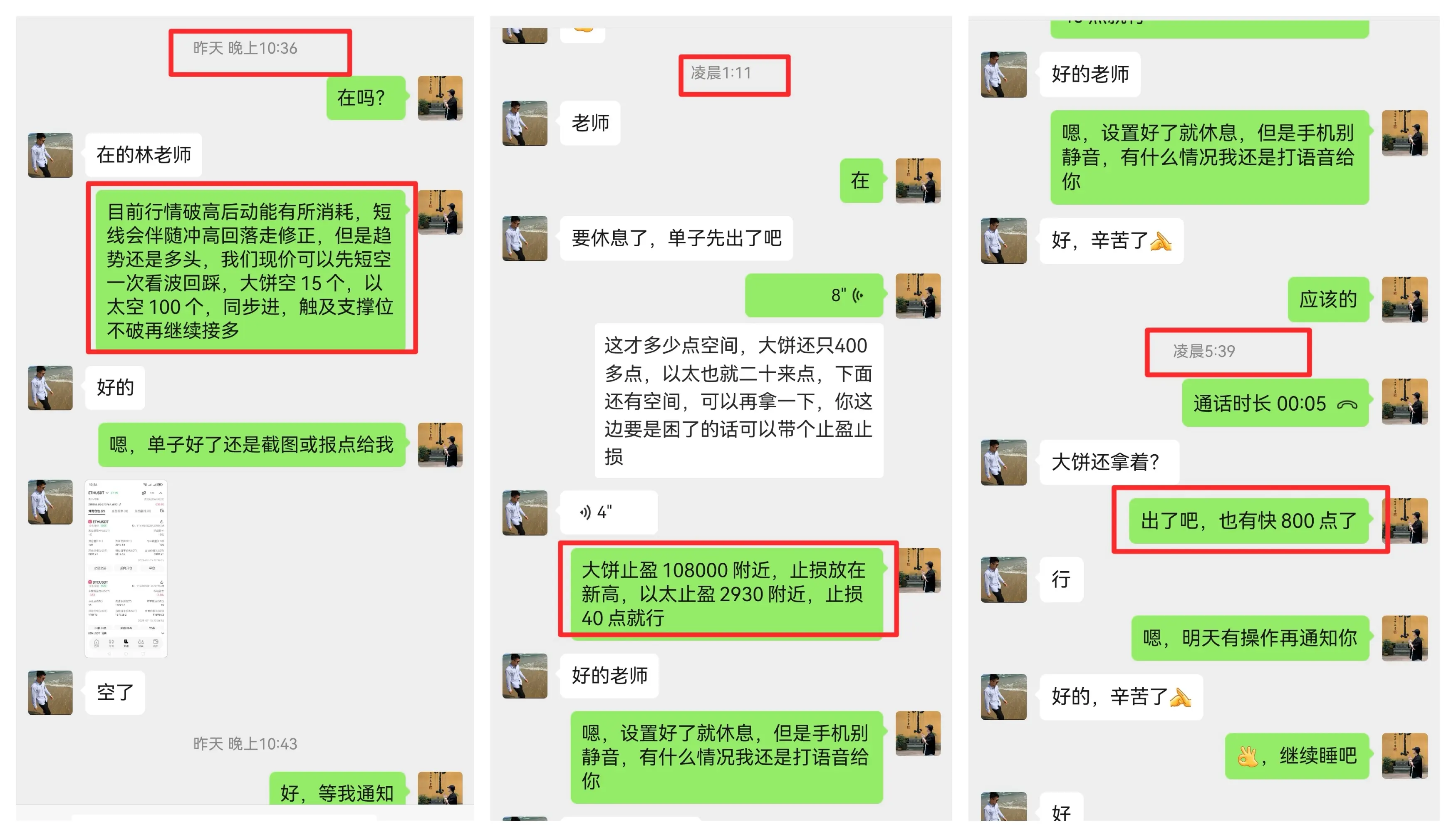

Yesterday, we had a clear idea from the morning session, relying on the main short position in the 115500-116000 conversion area, and we clearly indicated to short directly near 115500, looking down to around 113800 and 112300. During the US trading session, Bitcoin started to fall with higher trade volumes, with the coin price touching a low near 112600, and the overall trend was basically in line with our thoughts.

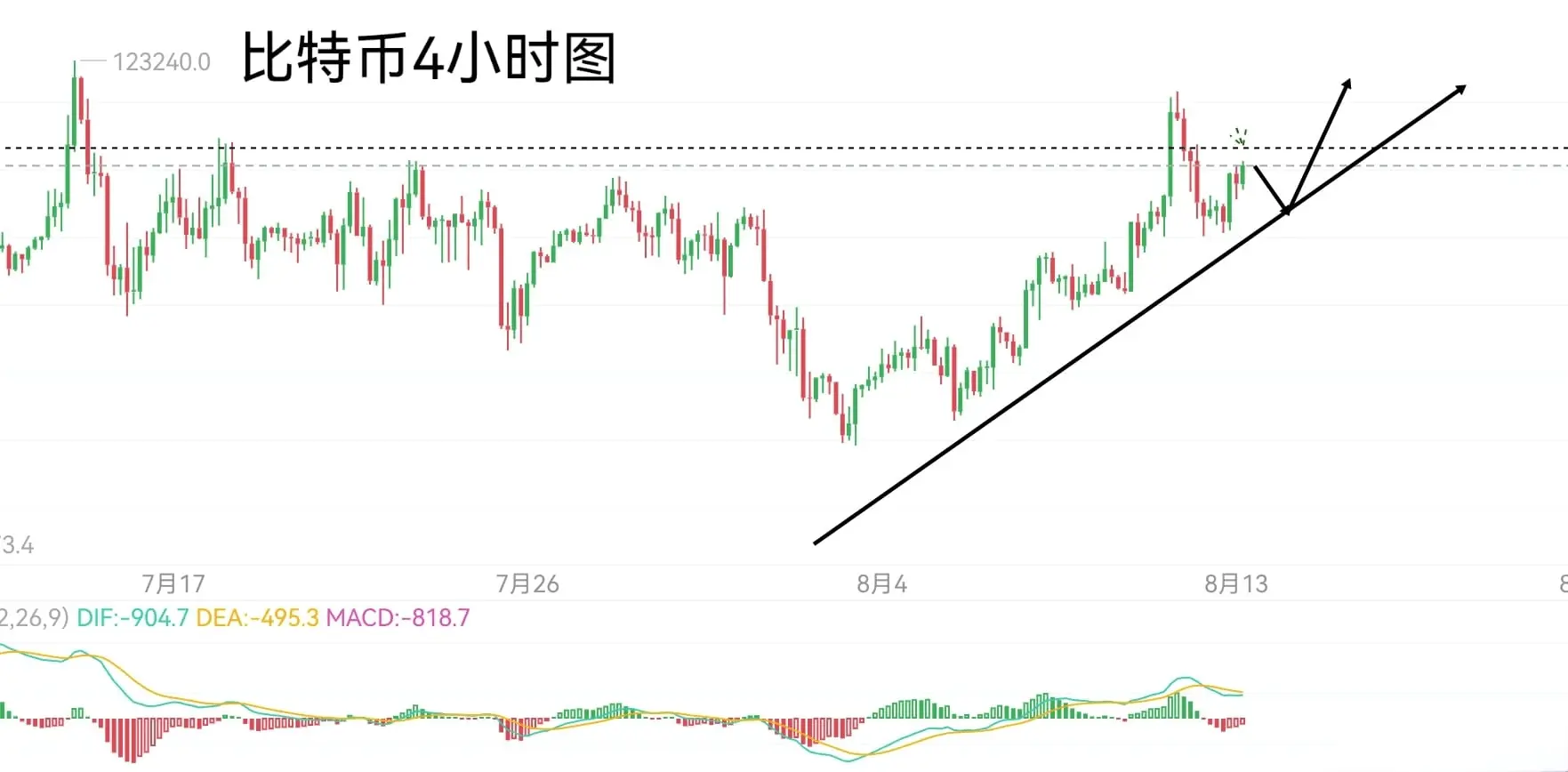

The price of Bitcoin formed a short-term top pattern after reaching a new high in mid-July, and then it continued to oscillate and retreat. After a long period of wide-ranging osc

View OriginalThe price of Bitcoin formed a short-term top pattern after reaching a new high in mid-July, and then it continued to oscillate and retreat. After a long period of wide-ranging osc

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

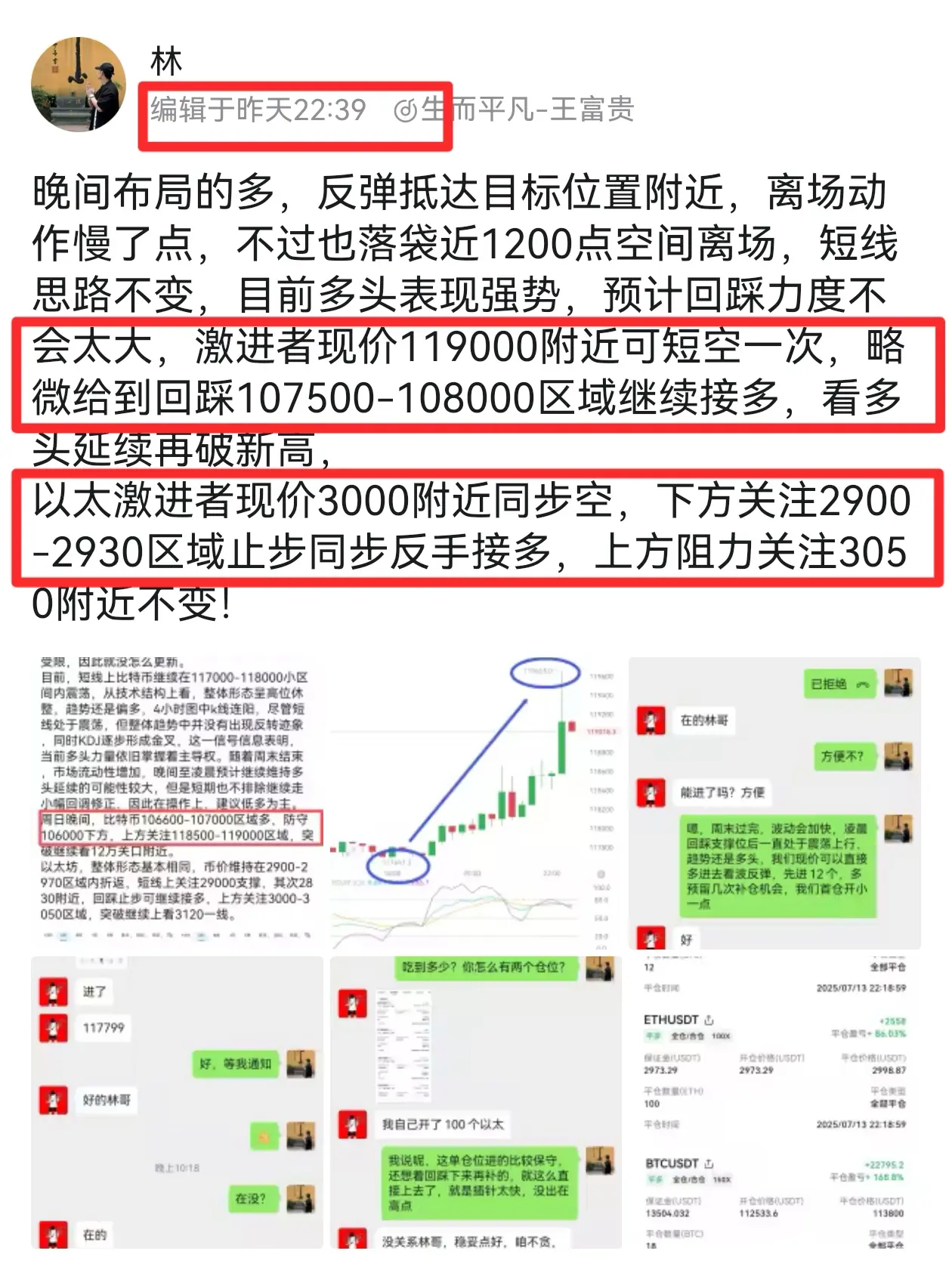

In the morning, we provided a shorting strategy around BTC 115500 and Ether 3730. Currently, BTC and Ether have both retreated as expected, with the lows reaching 114100/3642 respectively. Congratulations to those brothers who followed the strategy and have already gained profit.

After Bitcoin reached a temporary high in mid-July, it showed signs of a peak and subsequently entered a downward consolidation trend. Although there was a certain degree of rebound correction yesterday, the trend has not reversed, and it is still in a consolidation recovery phase. The short-term rebound is mainly a c

View OriginalAfter Bitcoin reached a temporary high in mid-July, it showed signs of a peak and subsequently entered a downward consolidation trend. Although there was a certain degree of rebound correction yesterday, the trend has not reversed, and it is still in a consolidation recovery phase. The short-term rebound is mainly a c

- Reward

- like

- Comment

- Repost

- Share

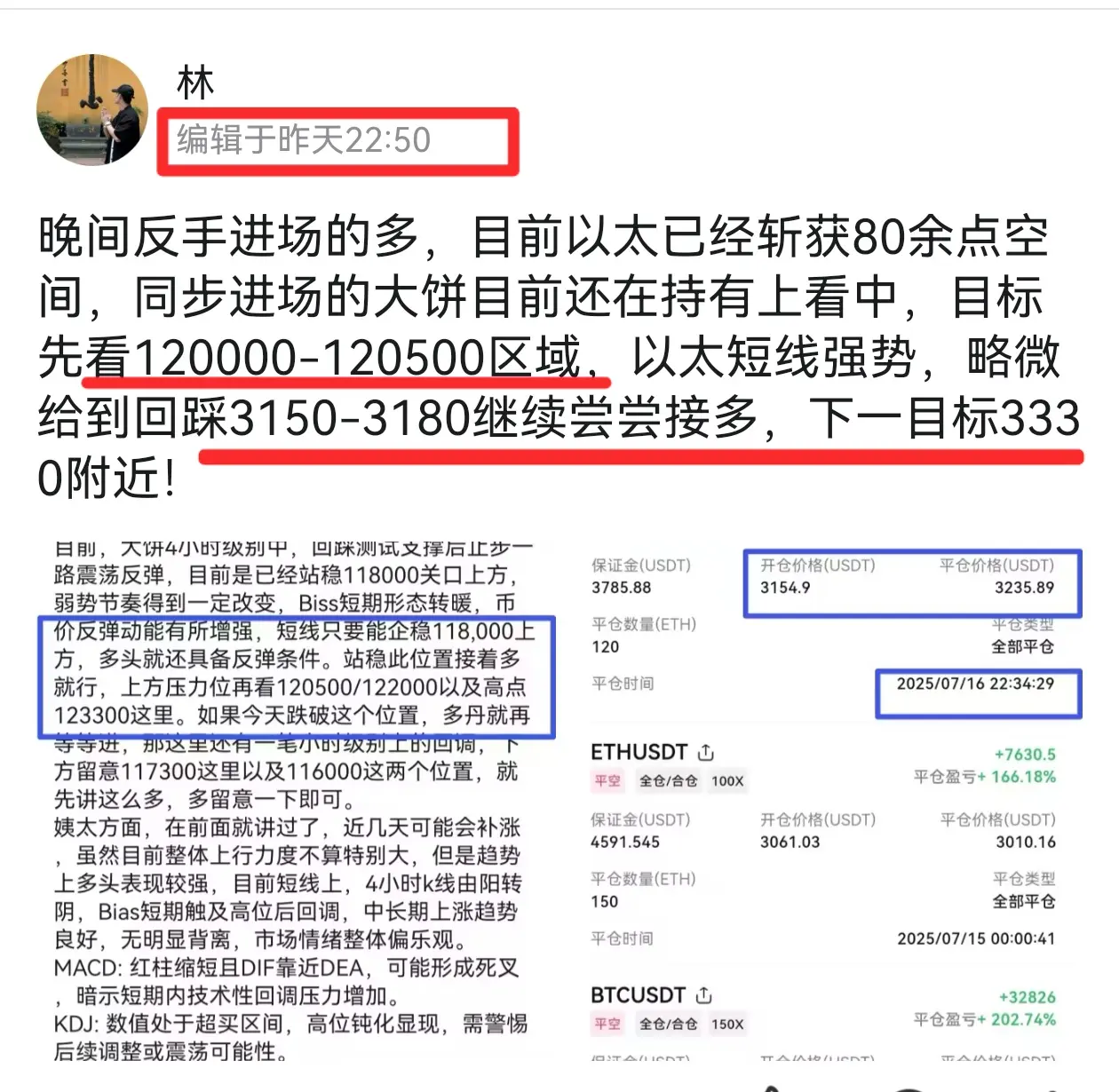

Yesterday, Ethereum continued to surge strongly, reaching a peak of 3423 in the early morning before pausing. The passing of the Crypto Assets bill greatly boosted market sentiment. At the same time, last night, an additional 2 billion USDT was added on-chain to Ethereum, causing the market funds to tilt towards Ethereum, resulting in a stronger performance compared to Bitcoin. Our strategy to go long at 3150-3180 with a target of 3330 was validated, and the surge even exceeded expectations. Those who entered at 3156 took profit at the 3327 level, earning over 170 points before exiting.

Curren

View OriginalCurren

- Reward

- like

- Comment

- Repost

- Share

Last night, the Bitcoin market once again refreshed its high point. After we took profit on our long order, the momentum of long positions weakened, followed by a pullback for correction. In the early morning, Ether hit the take profit position as expected, gaining 67 points. BTC's retracement was relatively small, only gaining over 700 points before exiting simultaneously. Subsequently, the coin price stopped and rebounded again, with short-term long and short positions caught in a stalemate. As of now, it is in a phase of oscillation and consolidation, but the trend has not changed, and the

View Original

- Reward

- like

- Comment

- Repost

- Share

On Friday, July 11, after a continuous strong rise, Bitcoin has now entered a correction phase. Although the strong rise of short-term long positions has somewhat halted, it is worth noting that in the current Bitcoin futures market, short positions account for 42% of the open contracts, mostly concentrated below the defensive level of 115,000. If the price continues to hold above the 117,000 mark, it may trigger a new round of short position closing amounting to 500 million dollars, further strengthening the pump momentum.

From the technical chart analysis, Bitcoin's current rise has solid te

View OriginalFrom the technical chart analysis, Bitcoin's current rise has solid te

- Reward

- like

- Comment

- Repost

- Share