USDT Meaning: In-Depth Analysis of the Stablecoin’s Definition and Future Outlook

1. USDT Project Background

Tether was founded in 2014, originally known as Realcoin, and later rebranded as Tether, co-founded by Craig Sellars, Reeve Collins, and Brock Pierce. The original intention of Tether was to create a digital currency pegged to fiat currency to reduce the volatility of the cryptocurrency market.

In 2014, Tether launched the first stablecoin USDT, issued on the Bitcoin-based Omni layer. Initially, USDT was issued through the Bitfinex exchange, which is Tether’s sister company. Over time, USDT gradually migrated to other blockchain platforms such as Ethereum, Tron, and Algorand to improve transaction speed and reduce costs. As of 2025, USDT is most active on Tron and Ethereum.

Tether claims that each USDT is backed by an equivalent amount of US dollars or other assets to ensure its stability. The company regularly releases reserve reports to prove the authenticity and transparency of its assets. However, Tether has faced controversies and regulatory scrutiny, especially during the 2019 investigation by the New York Attorney General’s Office, where it was accused of lack of transparency and potential improper conduct. Nevertheless, Tether has gradually restored market confidence by improving its reporting and auditing mechanisms.

2. USDT Technical Principles

USDT, as a stablecoin, its technical principles mainly include the following aspects:

- Anchoring mechanism: The value of USDT is maintained stable by pegging it to the US dollar at a 1:1 ratio. Tether claims that for every USDT issued, an equivalent amount of US dollars or other assets of equal value (such as short-term government bonds, cash equivalents) are held in a bank account.

- Blockchain platforms: USDT was initially issued on the Omni layer of Bitcoin and later migrated to platforms such as Ethereum, Tron, and Algorand. Different platforms offer different advantages, such as smart contract support on Ethereum and high throughput on Tron.

- Issuance and redemption: Users can convert US dollars into USDT through Tether company or partners (such as exchanges), and vice versa. This mechanism ensures the liquidity and value stability of USDT.

- Transparency and Audit: Tether regularly publishes reserve reports audited by third-party audit firms such as BDO to prove the authenticity and sufficiency of its assets. By 2025, Tether’s reserve reports have become an industry standard, demonstrating its commitment to transparency.

3. USDT Token Economics

The tokenomics model of USDT is relatively simple, but still includes the following key points:

- Total Issuance

Tether issues USDT based on market demand and the availability of reserve assets, without a fixed upper limit. In other words, as the demand in the crypto market grows, Tether can dynamically increase or redeem USDT to maintain a 1:1 peg to the US dollar and other equivalents. - Reserve Assets

According to the Q4 2024 Attestation released by Tether, the total reserve assets of Tether are approximately 143 billion USD, with over 79% being US Treasury bonds. These reserves also include other government bonds, cash, and cash equivalents, and other secure assets. Tether achieved a net profit of about 13 billion USD in 2024 and reached a historical high in US Treasury holdings. Tether officials claim that the reserve size is sufficient to support the amount of USDT issued, and will regularly prove the authenticity and liquidity of the reserve assets through audits or attestation reports. - Fee Structure

The transaction fees for USDT vary on different blockchains, with common issuing networks including Ethereum, Tron, and so on. Overall, the transaction fees for USDT are relatively low, making it suitable for frequent trading or cross-border remittances. At the same time, exchanges (such as Gate.io) may charge certain fees for the deposit, withdrawal, and trading of USDT, subject to the specific policies of the platform. - Governance Model

Tether is managed by its founding team and major investors, without providing a public token holder governance mechanism. The company will provide transparency to the community and regulatory agencies through official announcements, reserve proofs, regular audits, etc., but decision-making power and operational direction are mainly controlled internally by Tether.

The table below summarizes the composition of Tether’s reserve assets based on public information (data as of December 31, 2024, actual numbers may be adjusted):

Source:Tether Q4 2024 Attestation

Overall, USDT relies on a large reserve of assets and a flexible mechanism for issuance and redemption to maintain value stability, and enhances market confidence by continuously strengthening compliance and auditing processes. As of March 24, 2025, market data further shows that the circulation and trading volume of USDT continue to rise, solidifying Tether’s leading position in the stablecoin race.

4. USDT Market Analysis

As of March 24, 2025, the market value of USDT is approximately 14.348 billion USD, ranking third among all cryptocurrencies. As the largest stablecoin by market capitalization, USDT’s circulation and trading volume still lead other stablecoins (such as USDC, BUSD, etc.), playing an important role as a value anchor in the cryptocurrency market. With its characteristic of being pegged 1:1 to the US dollar, USDT is commonly used to hedge the high volatility risk of crypto assets, making it one of the most popular pricing and trading mediums on major exchanges (including Gate.io).

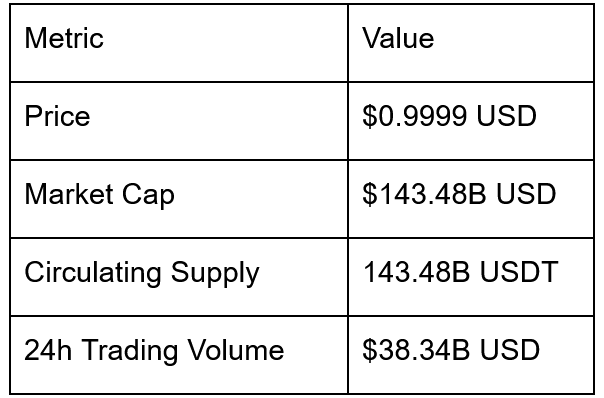

The table below shows the key market data of USDT (as of March 24, 2025):

Source:CoinMarketCap

From this table, it can be seen that the price of USDT usually stays around $1.00 USD, reflecting its core feature as a stablecoin. However, in extreme market conditions, USDT may also slightly deviate from the 1:1 ratio. According to the current AI model predictions, the price of USDT is likely to remain around $1.00 with relatively small fluctuations. Its greatest value for investors lies in providing a stable fiat currency alternative for trading and asset conversion, while reducing market risks associated with high cryptocurrency volatility.

It is worth mentioning that, according to historical data, the historical highest price of USDT reached about $1.22 on February 25, 2015, and the lowest price dropped to about $0.5683 on March 1, 2015. Currently, with the continuous improvement of the reserve proof and audit mechanism, USDT has gained high credibility in ensuring value stability and liquidity, and thus plays an indispensable role in the cryptocurrency ecosystem.

5. USDT Recent News and Market Dynamics

- In early 2025, Tether released its proof documents for the fourth quarter of 2024, showing a net profit of $13 billion for the year 2024, the highest in history. At the same time, Tether’s holdings of U.S. Treasury bonds reached a historical high of $113 billion, further consolidating its position as the world’s largest stablecoin issuer.

- On March 7th, Tether announced that it assisted the U.S. Secret Service in freezing $23 million of illegal funds related to the sanctioned exchange Garantex. This demonstrates Tether’s proactive role in combating financial crimes.

- On March 3, Tether appointed Simon McWilliams as Chief Financial Officer, marking further strengthening in the company’s financial management and audit.

These latest developments indicate that Tether has not only achieved significant growth in business scale but also made important progress in compliance and transparency.

Source:tether news

6. USDT Summary

As a pioneer in the stablecoin field, USDT has played a key role in the cryptocurrency market since its inception in 2014. Essentially, the biggest feature of USDT is its 1:1 peg to the US dollar, providing convenience for investors and businesses to hedge price fluctuations, as well as flexible liquidity support for cross-border transactions and the DeFi ecosystem. Over time, Tether has gradually strengthened the credibility of its reserve assets through multiple upgrades and transparency reports, and has collaborated with auditing firms to prove the adequacy and authenticity of its assets.

However, the stablecoin market itself still faces dual pressures of regulation and competition. Financial regulatory authorities worldwide have successively introduced new regulations to set stricter entry and compliance thresholds for cryptocurrencies and stablecoins. While USDT is gaining wider application scenarios, it also needs to continuously improve its institutional and technological aspects to ensure compliance with regulatory requirements and earn public trust.

Looking ahead, discussions around the meaning of USDT will delve deeper into its potential applications in global payments, value storage, and DeFi. With its substantial market value and widespread use, USDT is expected to further solidify its leading position in the stablecoin market and become an important bridge linking traditional finance with the blockchain world. As long as Tether continues to invest in transparency, audits, and compliance, the market influence and sustainable development prospects of USDT will continue to expand, providing a more stable and secure support for the entire cryptocurrency ecosystem.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

What is N2: An AI-Driven Layer 2 Solution

Grok AI, GrokCoin & Grok: the Hype and Reality

How to Sell Pi Coin: A Beginner's Guide

Crypto Trends in 2025