The Real Reason We Need Stablecoins

It’s me again, ranting about the KRW stablecoin.

But today I finally found out why our overlords are so eager to push stablecoins.

I think I found the their true motives behind all of this!

Let’s first read what the Financial News reports:

Ahn, a former Second Vice Minister of Economy and Finance, has recently formed a task force with the Ministry of Economy and Finance, the Bank of Korea, the Financial Services Commission, the Korea Capital Market Institute, and other relevant bodies to draft a bill on won-denominated stablecoins.

(…)

Ahn’s office plans to incorporate not only the basic eligibility and licensing requirements for stablecoin issuers, but also provisions covering collateral asset requirements, monetary policy management measures, foreign exchange transaction oversight, and user protection mechanisms.

Hwang Se-woon, a senior research fellow at the Korea Capital Market Institute who is part of Ahn’s won-denominated stablecoin task force, emphasized that only entities meeting strict eligibility criteria should be allowed to issue stablecoins, and that issuer status should be granted through a licensing system.

TLDR: there is a high probably that issuing a KRW stablecoin would require permission from the government.

But who are the most likely to get permission from the government? Maybe people who are close to them? Maybe established companies that are hinting they are preparing for it?

Nobody really knows who will be the true winner of this rushed policy, but seems like the market is already bidding hard on certain names.

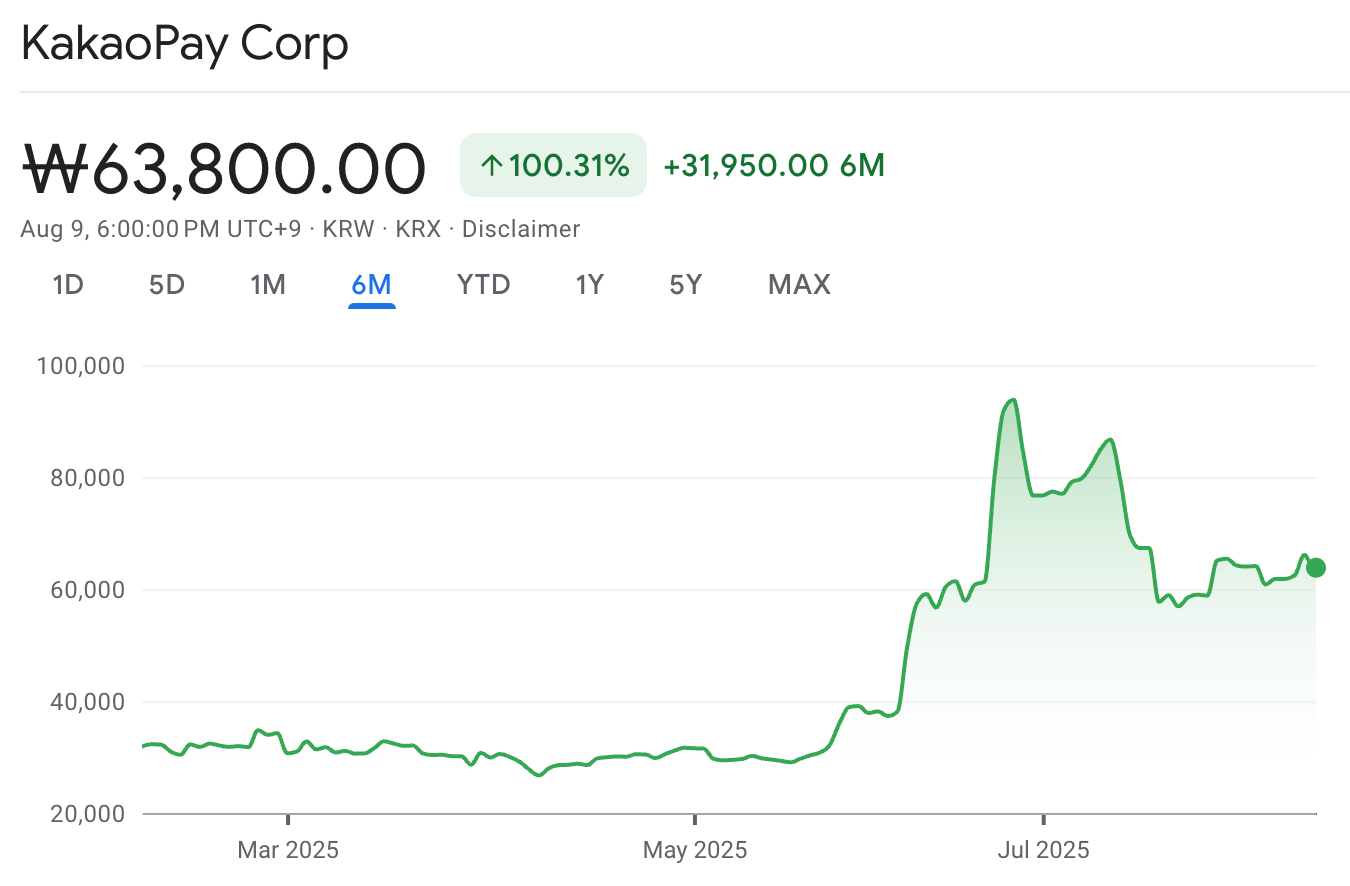

KakaoPay is one of the obvious candidates that are likely to benefit from KRW stablecoins as they are the one of the biggest payment apps in Korea.

With KakaoPay on the forefront, the Kakao Group is plotting to deploy their own bank, KakaoBank, to further their stablecoin dreams.

I guess the Korean degens will eat again, and the invisible hand is just doing its work.

But was the hand really invisible? Or was it perhaps, visible to some people?

Thank you 4k cameras

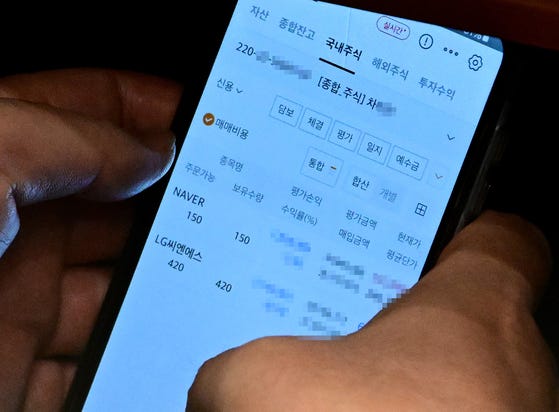

For capturing (potential) insider trading by our elected officials while reporting they own no securities.

Photo shows Rep. Lee Chun-seok of the Democratic Party of Korea trading stocks under someone else’s name at the National Assembly

According to an online media outlet The Fact, the previous afternoon, Chairman Lee was seen trading stocks such as Naver via a securities trading app on his mobile phone during a National Assembly plenary session. The problem was that the name on the account in the photo was not “Lee Chun-seok,” but his aide, Mr. Cha.

(…)

Although two such photos were taken over a span of 10 months, as of December 31 last year, Chairman Lee’s asset disclosure stated that neither he nor any of his family members held any stocks (securities). Under the Act on Real Name Financial Transactions and Confidentiality, all financial transactions must be conducted under a real name. Anyone engaging in a transaction under another person’s name for illegal purposes, such as concealing assets, may face up to five years in prison or a fine of up to 50 million won.

The good ole’ “I don’t give a fuck about cameras that can zoom in 125x behind my back, let me just check these bois pumping while I vote YES” really got me on this one.

There is no verdict if he really was doing any insider trading, but the mere fact that he was trading with his aide’s account just stinks of crime.

Speaking of crime, much is committed under the name of educational content.

At the 17:06 mark of the above video, the speaker claims that K-Pop and K-Culture might be a good use case for KRW stablecoins, regurgitating the same talking points of the politicians who are attempting to enact new laws about it.

What is truly astonishing about this video is not the video itself, though. When you look at the comment section it’s all disappointment expressed towards the channel owner:

“What’s up with you? You’re trying to get elected?”

”I guess I’ve been giving Hyoseok way too much credit all this time…”

“What’s going on here? Did the government threaten you into posting this video? lol… hmm.”

However, seeing comments showing discontent towards the brainwash attempt actually made me feel dreadful because the realization of the fact that the ones who are raising questions here are probably the absolute minority in this country just hit me.

Most people don’t even give a damn fuck about what a stablecoin is, and won’t even care how it works. Only the financial literate have enough sense to tackle and care about these things.

The current administration has a 65% approval rating. Of course the free 100 dollar money coupons had nothing to do with that!

Just sling out more free money and eventually they might reach their goals.

WAGMI

Disclaimer:

- This article is reprinted from [Juhyuk]. All copyrights belong to the original author [MORBID-19]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

What is Stablecoin?

Top 15 Stablecoins

A Complete Overview of Stablecoin Yield Strategies

What Is USDT0