CryptoPunks sparked a summer NFT boom: Was it just a fleeting craze, or does it signal a lasting change in market trends?

The long-dormant NFT market is firmly back in the spotlight.

At 5:00 a.m. UTC on July 21, a single wallet spent 2,082 ETH (approximately $7.91 million) to acquire 45 CryptoPunks NFTs. In a market that’s been quiet for months, with low liquidity and few fresh projects, such a big-ticket purchase was a real outlier.

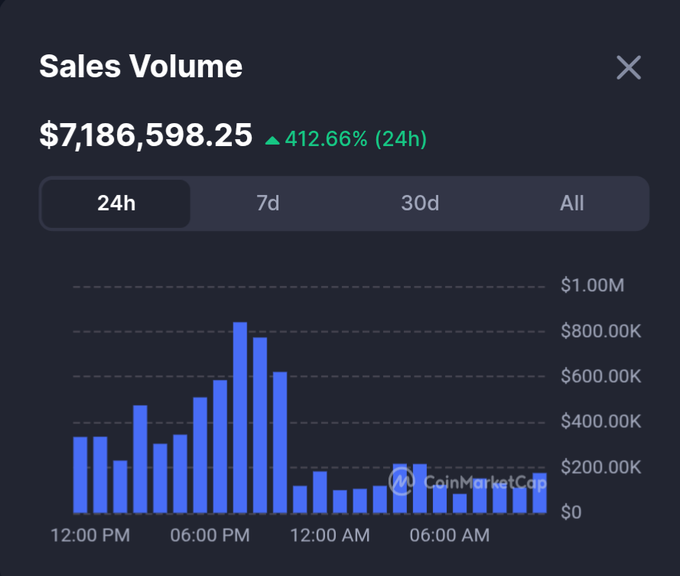

The NFT market responded instantly to the news. Within 24 hours, overall trading volume soared by 412%. Over the past two weeks, the price of the Pudgy Penguins NFT collection, Pengu, jumped more than 157%.

The momentum of “alt season” has clearly swept into NFTs.

But does this signal the comeback of NFT Summer, or is it just a bull market indicator?

The NFT Market Reignites

It’s not just CryptoPunks—virtually all former blue-chip NFT projects have seen sharp gains in both trading volume and floor prices over the past 24 hours.

As of 5:00 p.m. UTC on July 21, the total NFT market cap reached $668 million, up 28.1% in 24 hours, with trading volume soaring 368.4% to $45 million. Key blue-chip NFT stats:

CryptoPunks floor price: 47.9 ETH (about $182,000), up 16.9% in 24 hours. Trading volume: 4,090 ETH (about $15.5 million).

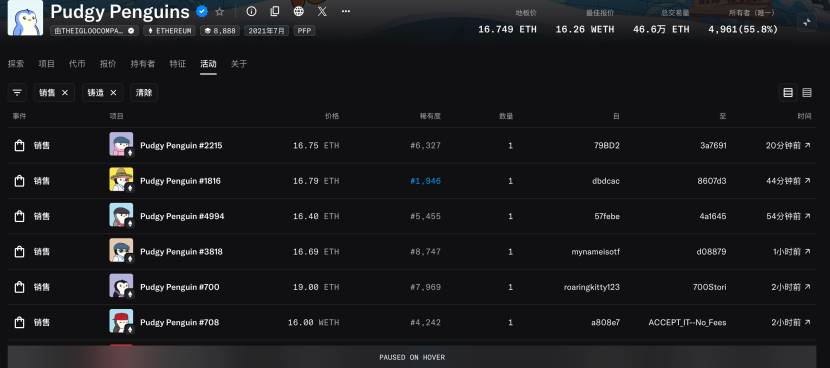

Pudgy Penguins floor price: 16.75 ETH (about $63,600), up 16.5% in 24 hours. Trading volume: 1,698 ETH (about $6.43 million).

Bored Ape Yacht Club floor price: 13.24 ETH (about $50,300), up 20.8% in 24 hours. Trading volume: 934 ETH (about $3.53 million).

Moonbirds floor price: 1.94 ETH (about $7,372), up 32.1% in 24 hours. Trading volume: 528 ETH (about $2 million).

Azuki floor price: 2.43 ETH (about $9,234), up 27.4% in 24 hours. Trading volume: 367 ETH (about $1.39 million).

Although surprising to some, the NFT market truly is warming up again. Both volume and social chatter are in a clear uptrend. The rise in BTC and ETH can be attributed to ongoing capital inflows, but the unexpected resurgence of a “dead” NFT sector has caught most people off guard—fueling intense market debate.

Sector Rotation or Temporary Peak?

With ETH trending up, optimists say this NFT renaissance is classic sector rotation.

Investors who scored big in ETH and related projects are now setting their sights on NFTs, with blue-chip collectibles drawing the most attention.

One popular narrative is that rising prices spark pent-up demand—and that NFTs are evolving from mere crypto art into utility tools. More developers are integrating NFTs for asset issuance, DeFi, and DAO governance. This renewed NFT activity, they argue, could keep ETH’s momentum running hot.

Countless investors burned in the last NFT downturn are now hoping for a true NFT Season comeback.

Still, there’s no shortage of skeptics questioning the sustainability of this surge.

The bearish camp argues that the NFT rally is reminiscent of prior bull market tops, where meme mania dominates. Historically, when meme tokens skyrocket across the board, the market soon flips from bull to bear.

Experience shows that a big run in NFTs often means capital is chasing ever-riskier bets—typically a sign that a bull market top is near, with a correction likely to follow.

Whether bullish or bearish, most agree: something’s brewing behind the scenes, and major developments could be on the horizon.

NFTs as Strategic Corporate Assets: Following BTC and ETH

More companies have started adding crypto to their balance sheets as strategic reserves, and these announcements often drive stock prices higher. This raises the question: could NFTs join BTC and ETH as official strategic holdings?

On July 21, YugaLabs co-founder Greg Solano tweeted a hint that it’s only a matter of time before companies start treating NFTs as part of their strategic reserve assets.

That same day, U.S.-listed GameSquare Holding announced it would increase its crypto asset management fund from $100 million to $250 million, launching a new Ethereum NFT yield strategy, starting with a $10 million allocation and targeting a 6-10% annual yield.

This string of developments suggests that “NFTs as corporate strategic assets” is quickly becoming a reality. We’re likely to see more companies adding NFTs to their business strategies. After all, if everyone’s moving into Web3, how can they not have a distinctive Web3 presence?

On July 21, Ethereum also released its 10th anniversary commemorative NFT, “The Torch,” available for minting through July 30. Whether this will fan the flames of the current NFT boom remains to be seen in the coming market action.

Image source: @Ethereum

The NFT narrative is always compelling, but the reality is far less glamorous.

It remains uncertain whether this NFT revival will further ignite altcoin rallies or mark a turning point before a broader market correction.

What’s certain is that this once-dismissed sector is back in focus—prompting many collectors who had been holding losses to open their wallets again and relive the earlier days of crypto art exuberance.

Disclaimer:

- This article is republished from [TechFlow], with copyright held by the original author [TechFlow]. For any concerns about republication, please contact the Gate Learn team. We will address your request in line with our procedures.

- Disclaimer: The opinions and views expressed are solely those of the author and do not constitute investment advice.

- Other language versions are translated by the Gate Learn team and may not be copied, distributed, or plagiarized without attribution to Gate.

Related Articles

Top 10 NFT Data Platforms Overview

7 Analysis Tools for Understanding NFTs

What is NFTs Marketplace Aggregator?

What is Galxe (previously Project Galaxy)? All You Need to Know About GAL 2025