This Tokenless DEX Earns More Than Uniswap

Most people know that trading perpetual contracts is the most profitable activity in crypto.

But imagine this: a low-profile Perp DEX named edgeX, operating for just one year, has topped the 24-hour revenue chart—outperforming major blockchains like Ethereum and Base. Over a 7-day period, edgeX surpassed industry giants such as Uniswap, Jupiter, AAVE, and Lido. Not only is edgeX one of the few top-15 daily revenue projects that hasn’t launched a token, it also offers the deepest BTC and ETH liquidity among all perp DEXs within a 0.01% price spread.

This new revenue “beast” is called edgeX.

What’s Driving This Explosive Revenue Curve?

Unlike more familiar names like Hyperliquid, edgeX is a Perp DEX built on a zero-knowledge (ZK) architecture. The project was incubated by Amber, with a core team of seasoned professionals from Goldman Sachs, Jump Trading, and other leading firms with deep high-frequency trading expertise. edgeX positions itself as a “full-stack on-chain financial hub,” operating not only a perp DEX but also two additional product lines: eStrategy (a treasury solution) and the edgeX chain.

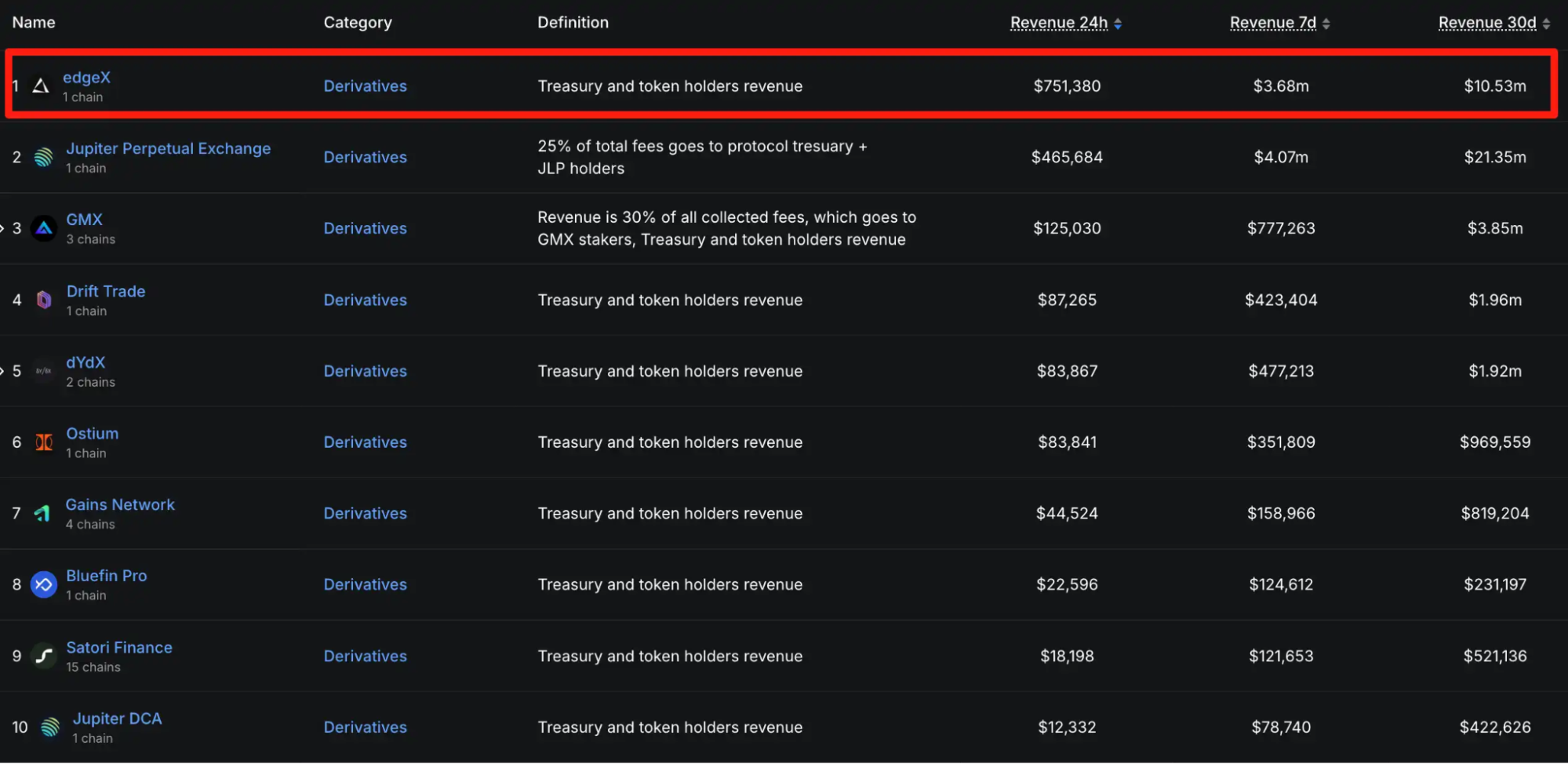

As noted at the beginning, quality is reflected in revenue. Directly comparing edgeX’s income to other perp DEXs makes its growth even more apparent.

In just its first year, edgeX earned $10.53M in transaction fees over the last 30 days—eclipsing established players like GMX ($3.85M) and dYdX ($1.92M). In short, edgeX generated more than double GMX’s revenue and over five times that of dYdX.

Source: DefiLlama

So, how did edgeX rocket into the top tier of perp DEXs by revenue? The answer likely comes down to what matters most to traders: liquidity depth and low fees.

When it comes to liquidity, edgeX currently ranks second among all perp DEXs. Take the flagship BTC/USDT pair: within a 0.01% price band, edgeX’s order book can support up to $6M in BTC trades—outpacing Hyperliquid ($5M), Aster ($4M), and Lighter ($1M). While edgeX’s aggregate liquidity is just shy of Hyperliquid’s, for most tokens edgeX offers the deepest liquidity aside from Hyperliquid. For a deep dive, see edgeX research lead Dan’s recent piece, “Understanding DEX Liquidity: A Comparative Look at Trading Efficiency.”

edgeX’s fee schedule is also highly competitive: just 0.015% for makers and 0.038% for takers, significantly undercutting Hyperliquid’s 0.045%. Users who register with an ambassador referral can unlock VIP1 status, further lowering their taker fee to 0.036%. Ambassadors can earn up to 35% in trading fee rebates—helping users save on costs while stacking up airdrop points.

These advantages in liquidity and fee structure have created a strong moat for edgeX, fueling its impressive revenue growth curve. Even without an issued token, edgeX has already demonstrated the capability for ongoing “token buybacks” and the ability to drive ecosystem growth organically.

There’s another noteworthy point when you look at the global protocol revenue leaderboard. In the top 15 (excluding the issuers of USDT and USDC), only four protocols haven’t yet launched a token, and edgeX is one of them.

Source: DefiLlama

Many in the Chinese-speaking community might not be familiar with this rising star, as edgeX rarely leverages narrative-driven marketing and its user base is primarily concentrated in Korea and North America.

In summary, edgeX stands out as a rare “alpha”: high revenue, low valuation, and currently no token in circulation.

edgeX now uses edgeX Points as a rewards metric, distributed weekly; to date, 2.4 million points have been awarded. Points can be earned through trading, holding, treasury participation, referrals, and more. The Messenger Ambassador Program is now underway.

Trading volume can be faked, but real profits can’t be faked. Whether in traditional finance or web3, actual “user willingness to pay” is the truest test of a product’s sustainability.

In under a year, edgeX has driven its cash flow into the industry’s top 15. That’s a remarkably clear growth trajectory—and a solid alpha. So what fully diluted valuation (FDV) will edgeX debut with, and how will it reward early adopters? Time will tell.

Disclaimer:

- This article is reprinted from [BlockBeats]. Copyright belongs to the original author [Jaleel加六]. If you have any concerns about this reprint, please contact the Gate Learn team. The team will handle it promptly according to the relevant procedures.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions of this article were translated by the Gate Learn team. Without mention of Gate, reproduction, distribution, or plagiarism of the translated article is prohibited.

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

Sui: How are users leveraging its speed, security, & scalability?

What is Stablecoin?

Arweave: Capturing Market Opportunity with AO Computer

Exploration of the Layer2 Solution: zkLink