#ETH is under short-term pressure while building strength, with a breakthrough imminent in the medium term.

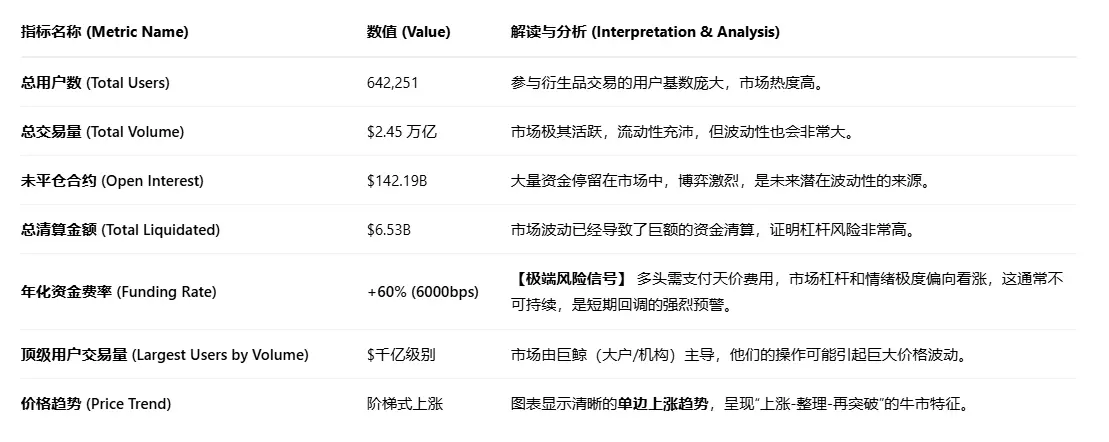

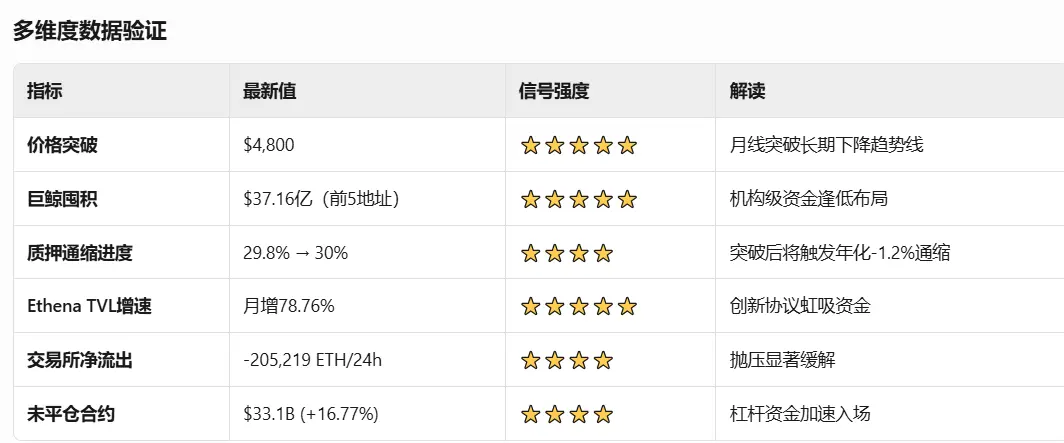

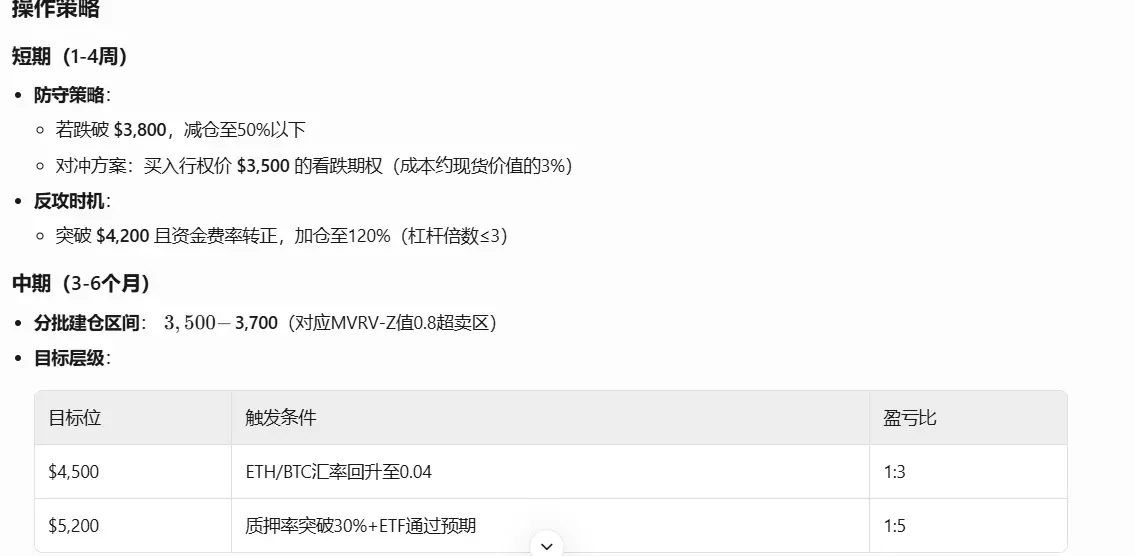

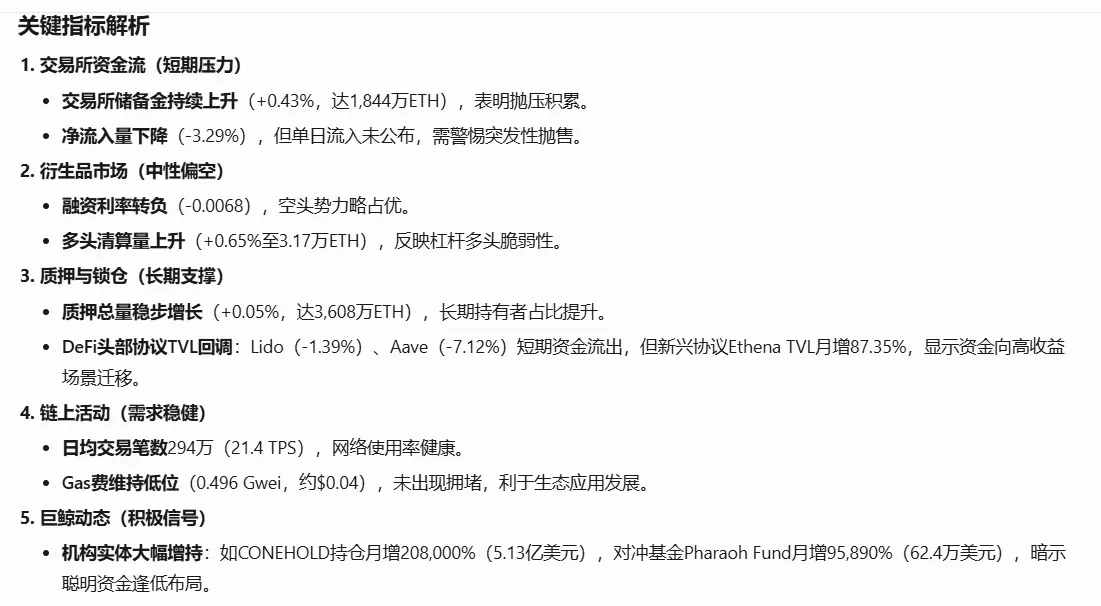

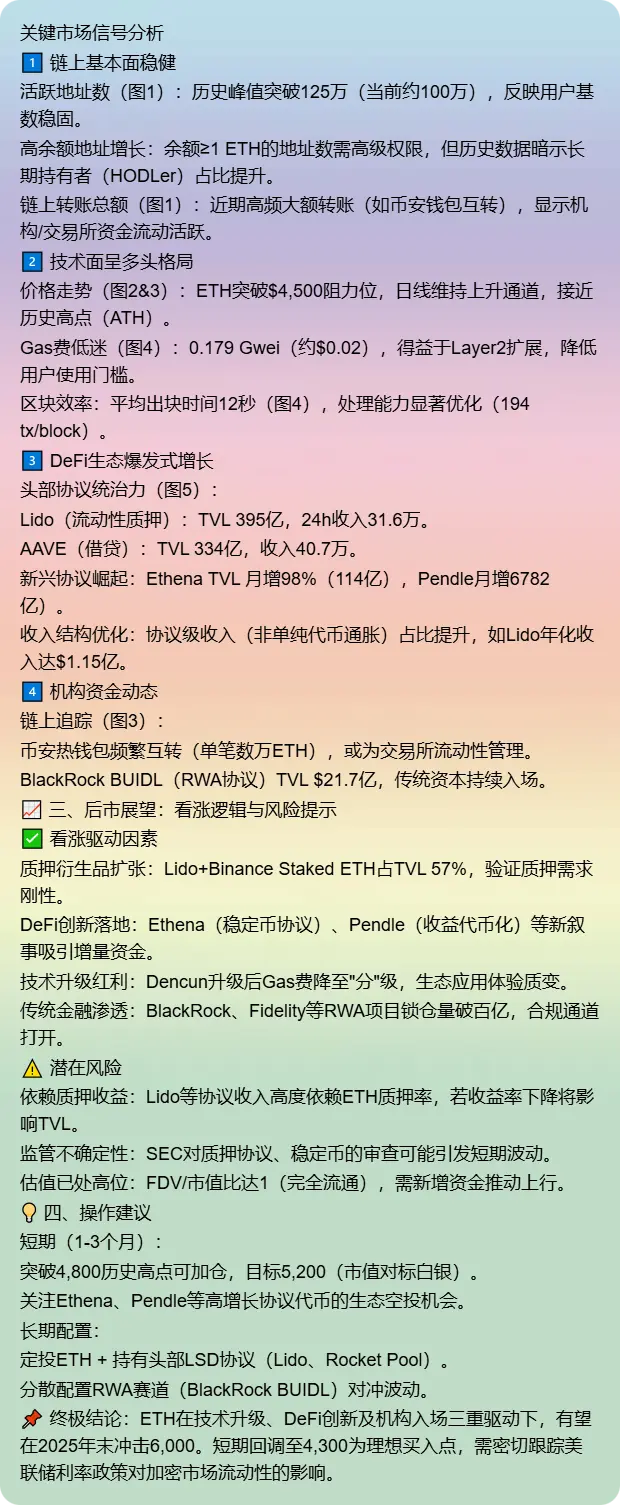

Short-term pressure: Exchange reserves increase to 18.54M ETH (+0.1%), derivatives shorts dominate (funding rate turns negative), need to be cautious of a pullback to the $3,800 support level.

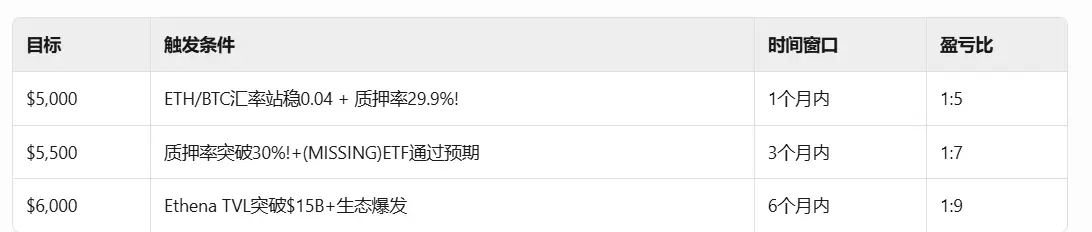

Mid-term momentum: Whales are hoarding against the trend (single address deposits of 2.108 billion), staking volume is steadily increasing (36.12M ETH, +0.114,500) savings power.

Long-term trend: Monthly line stabilizes at 4,200 (breaking the 2021 downtrend line), bull market structure remains unch

View Original