Murphy_sEncryptionTheo

You have money to make, I also have money to make, let's cooperate for a win-win situation! I don't like beating around the bush, please forgive me for being a common person! QQ: 3221958650

Murphy_sEncryptionTheo

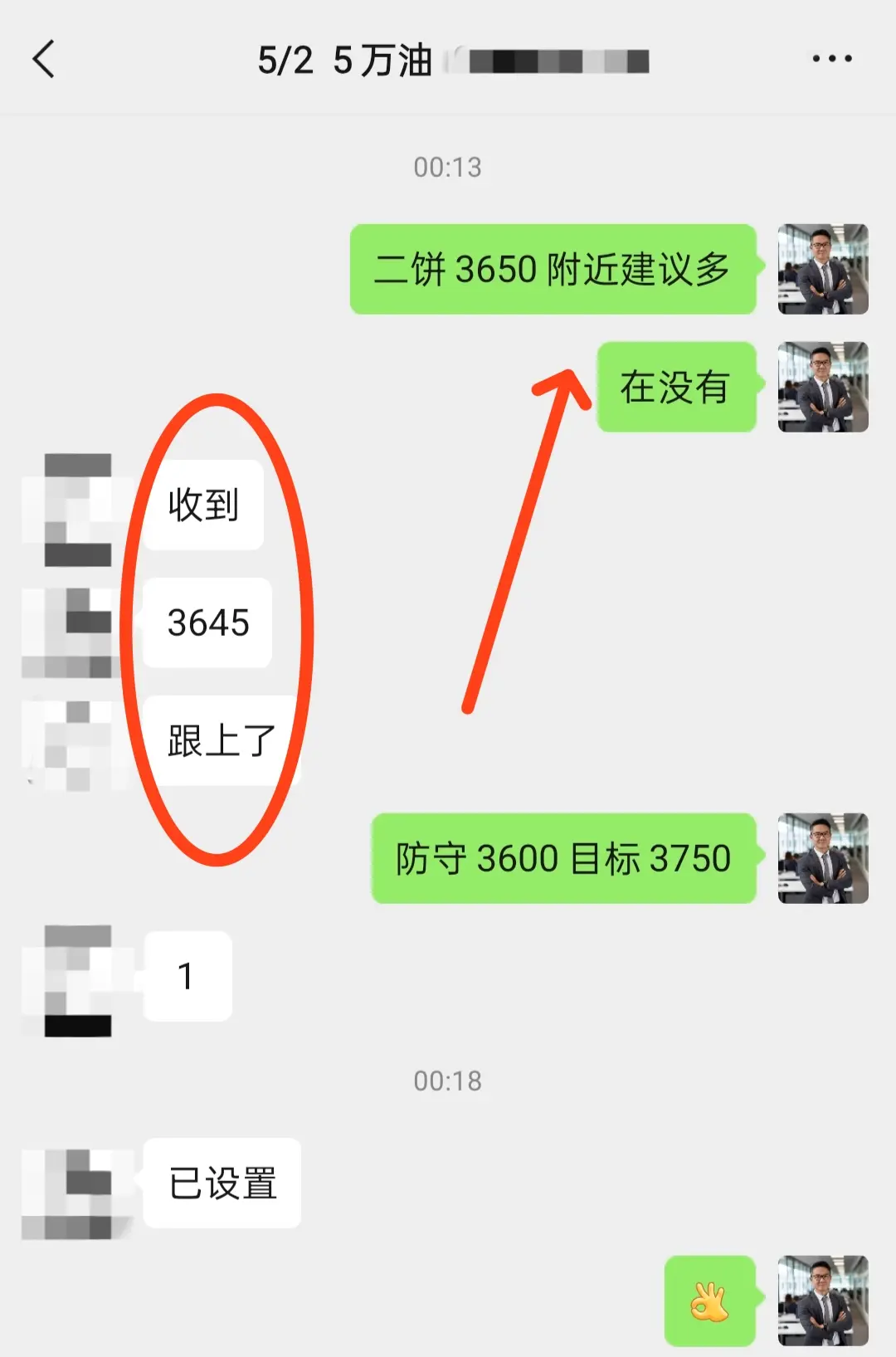

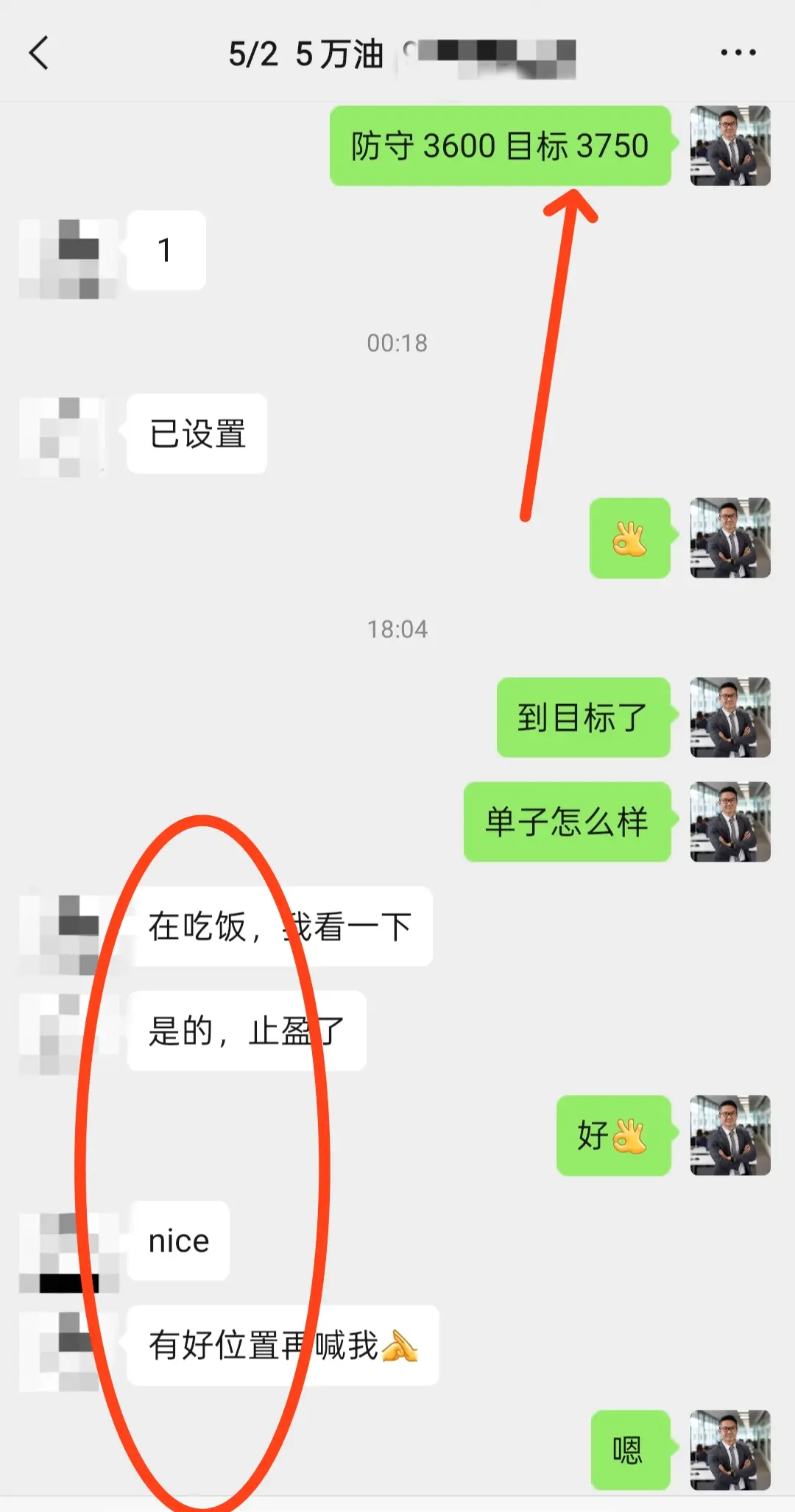

Medium to long-term two-pie layout, buy around 3645, directly exit at 3750, pocketing 105 points!

View Original

- Reward

- like

- Comment

- Share

Morning thoughts on August 7th, Bitcoin has a small gain of 900 points, and Ethereum has a small space of 60 points!

BTC1.27%

- Reward

- like

- Comment

- Share

ETH strategy for August 7th:

The current ETH market presents a relatively complex pattern. From a technical perspective, the overall market is in an upward trend, with a bullish arrangement of moving averages and a golden cross forming a strong bullish resonance. However, the extreme contraction in trading volume and the continuous rise in price ratios have created a significant divergence between volume and price, indicating insufficient upward momentum at present, with prices facing a pullback pressure as they approach resistance levels.

ETH Operation Suggestions: Direction 🈳, target to be

The current ETH market presents a relatively complex pattern. From a technical perspective, the overall market is in an upward trend, with a bullish arrangement of moving averages and a golden cross forming a strong bullish resonance. However, the extreme contraction in trading volume and the continuous rise in price ratios have created a significant divergence between volume and price, indicating insufficient upward momentum at present, with prices facing a pullback pressure as they approach resistance levels.

ETH Operation Suggestions: Direction 🈳, target to be

ETH5.17%

- Reward

- like

- 1

- Share

Peterge :

:

Quick, enter a position!🚗OKB strategy for August 7th:

The current OKB market is in a low-level consolidation phase, with technical indicators showing potential for a short-term rebound. The emergence of a hammer candlestick pattern and the oversold condition of the RSI suggest that market sentiment may be brewing a reversal. However, the moving average system still displays a bearish arrangement, and the extremely low trading volume combined with price being below the VWAP creates a divergence signal, weakening the certainty of the rebound.

OKB Operation Suggestion: The direction is bullish, the target is up to you to

The current OKB market is in a low-level consolidation phase, with technical indicators showing potential for a short-term rebound. The emergence of a hammer candlestick pattern and the oversold condition of the RSI suggest that market sentiment may be brewing a reversal. However, the moving average system still displays a bearish arrangement, and the extremely low trading volume combined with price being below the VWAP creates a divergence signal, weakening the certainty of the rebound.

OKB Operation Suggestion: The direction is bullish, the target is up to you to

OKB1.03%

- Reward

- like

- Comment

- Share

SOL strategy for August 7th:

The current SOL market is in a typical range-bound state, fluctuating between the support level of 155.72 and the resistance level of 168.50. The technical indicators show entangled moving averages, weakening momentum, and a contraction of the BOLL bands, indicating a balanced market sentiment, normal volatility, and a lack of clear trend signals. At the same time, the recent bullish engulfing pattern has not received confirmation from trading volume, further increasing the possibility of a false breakout.

SOL Operation Suggestion: Direction 🈳, target at your disc

The current SOL market is in a typical range-bound state, fluctuating between the support level of 155.72 and the resistance level of 168.50. The technical indicators show entangled moving averages, weakening momentum, and a contraction of the BOLL bands, indicating a balanced market sentiment, normal volatility, and a lack of clear trend signals. At the same time, the recent bullish engulfing pattern has not received confirmation from trading volume, further increasing the possibility of a false breakout.

SOL Operation Suggestion: Direction 🈳, target at your disc

SOL1.42%

- Reward

- like

- Comment

- Share

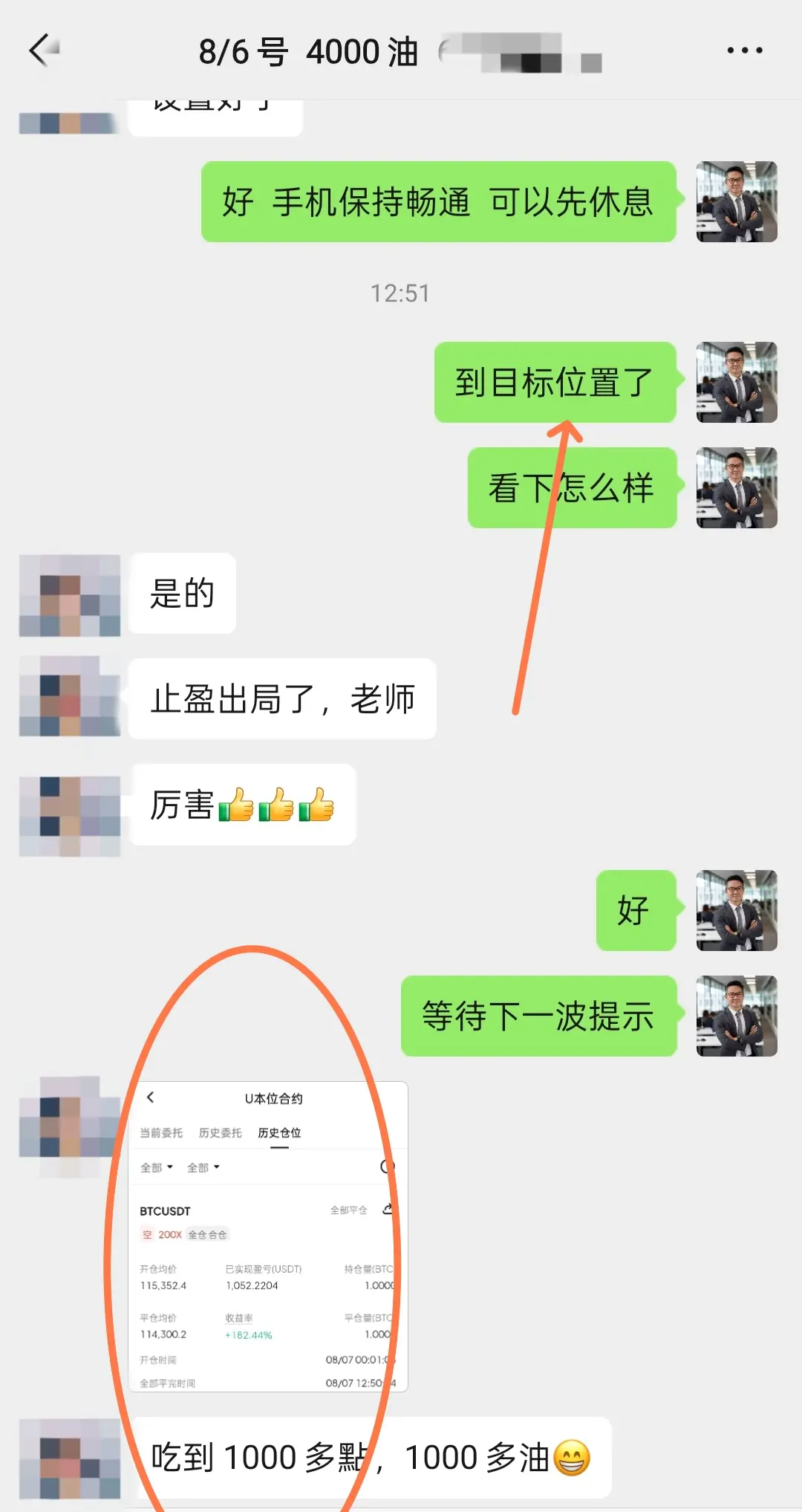

Yesterday, a new partner joined, and the position wasn't very large. In the early morning, I joined the VIP queue for a big layout, got 1052 points, and 1000 oil in the bag!

BTC1.27%

- Reward

- like

- Comment

- Share

BNB strategy for 8/7:

The current BNB market presents a complex pattern of interwoven technical and macro elements. The technical analysis shows that the market is in an upward trend, with a bullish alignment of moving averages and a golden cross forming a strong bullish signal, while the short-term price is above the key moving averages. However, the significant shrinkage in trading volume has led to a divergence between price and volume, indicating that the current rise lacks healthy support, and the market may face a risk of correction.

BNB Operation Suggestions: Direction 🈳, target to be

The current BNB market presents a complex pattern of interwoven technical and macro elements. The technical analysis shows that the market is in an upward trend, with a bullish alignment of moving averages and a golden cross forming a strong bullish signal, while the short-term price is above the key moving averages. However, the significant shrinkage in trading volume has led to a divergence between price and volume, indicating that the current rise lacks healthy support, and the market may face a risk of correction.

BNB Operation Suggestions: Direction 🈳, target to be

BNB0.76%

- Reward

- like

- Comment

- Share

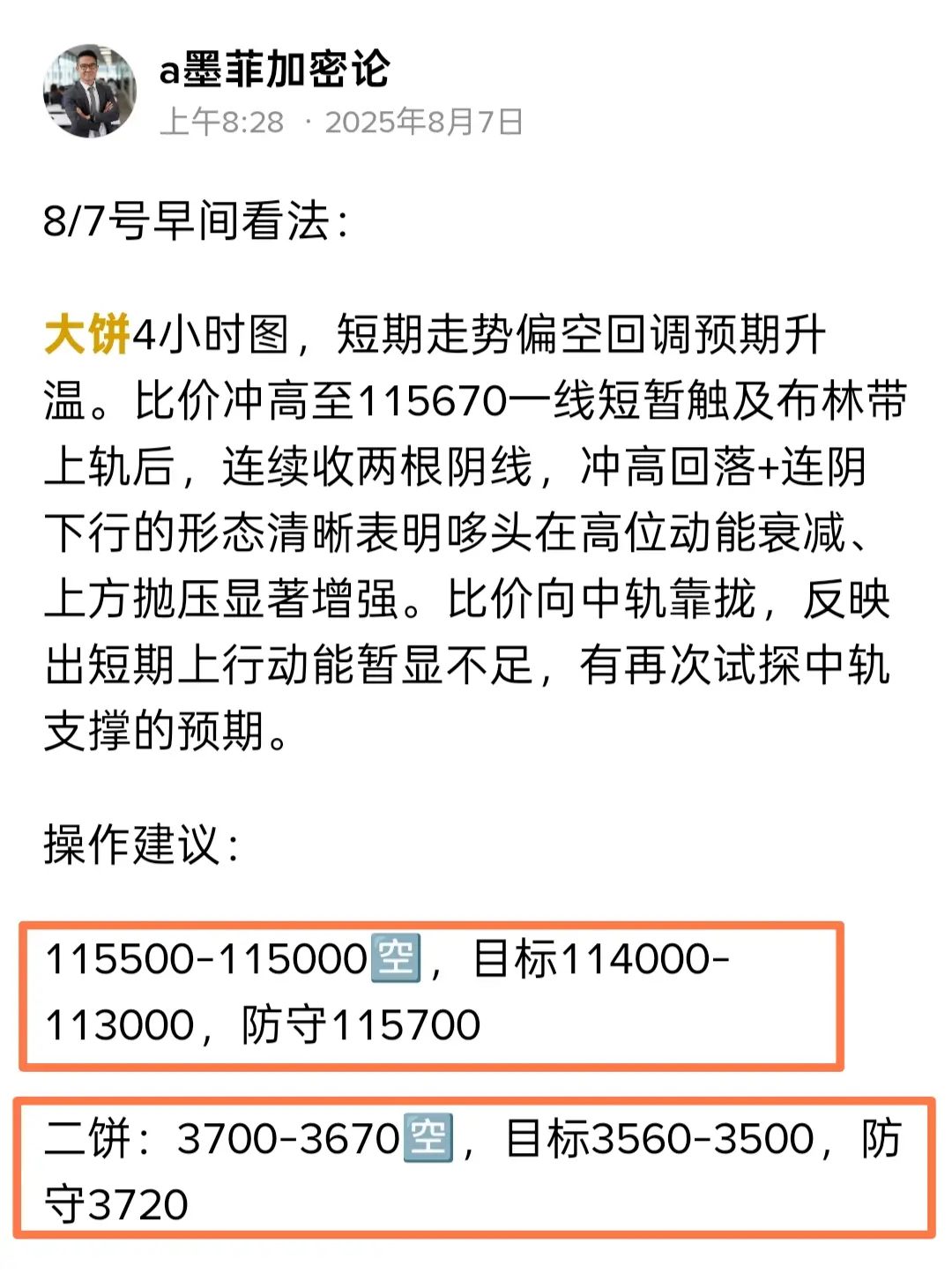

Morning outlook on August 7th:

The 4-hour chart of Bitcoin shows that the short-term trend is leaning towards a bearish correction expectation. After briefly touching the upper Bollinger Band at the resistance level of 115670, it has consecutively closed two bearish candles. The pattern of a high pullback combined with consecutive downward candles clearly indicates that the momentum at the high level is diminishing, and the selling pressure above has significantly increased. The price is approaching the middle band, reflecting a temporary insufficiency in short-term upward momentum, with an ex

View OriginalThe 4-hour chart of Bitcoin shows that the short-term trend is leaning towards a bearish correction expectation. After briefly touching the upper Bollinger Band at the resistance level of 115670, it has consecutively closed two bearish candles. The pattern of a high pullback combined with consecutive downward candles clearly indicates that the momentum at the high level is diminishing, and the selling pressure above has significantly increased. The price is approaching the middle band, reflecting a temporary insufficiency in short-term upward momentum, with an ex

- Reward

- like

- Comment

- Share

On the evening of August 6th, the major coin has 1700 points, and the second coin also has a small space of about 60 points!

BTC1.27%

- Reward

- like

- Comment

- Share

On the evening of August 6th, the strategy was to cash in Bitcoin at 1100 points!

View Original

- Reward

- 3

- 1

- Share

Onlybosal :

:

come on rich in vitamin e and vitamin e and vitamins and BTC evening strategy for August 6:

The BTC daily chart shows that the recent price ratio has gradually narrowed after significant fluctuations, forming a consolidation pattern. Yesterday, a long lower shadow appeared, indicating strong buying support at lower levels. In the 4-hour chart, the current candlesticks show alternating small bearish and bullish patterns, reflecting a temporary balance of buying and selling forces in the market. In the MACD 4-hour cycle, both the DIF and DEA are still below the zero axis, but the green bars have shortened, indicating a weakening of bearish momentum.

O

View OriginalThe BTC daily chart shows that the recent price ratio has gradually narrowed after significant fluctuations, forming a consolidation pattern. Yesterday, a long lower shadow appeared, indicating strong buying support at lower levels. In the 4-hour chart, the current candlesticks show alternating small bearish and bullish patterns, reflecting a temporary balance of buying and selling forces in the market. In the MACD 4-hour cycle, both the DIF and DEA are still below the zero axis, but the green bars have shortened, indicating a weakening of bearish momentum.

O

- Reward

- like

- Comment

- Share

What? The timeline is reversed? Teacher, why is your afternoon strategy already in the bag while the morning strategy is still behind? If we don't understand the entry positions for long and short trades, how can we do well? Morning strategy, Bitcoin 700 points, second coin 50 points in the bag!

View Original

- Reward

- like

- Comment

- Share