Why Bitcoin Needs Layer-2s

This module explains the technical limits of Bitcoin’s base layer—such as low throughput, high latency, and lack of programmability, and introduces the Layer-2 approach as a way to scale Bitcoin without changing its core protocol. It introduces key design models and types of Layer-2s like payment channels, sidechains, rollups, and BitVM.

Bitcoin Layer-1 Limits

The Bitcoin network processes transactions through a decentralized, global consensus mechanism. Roughly every 10 minutes, miners collect pending transactions into a block and append it to the blockchain. This fixed block interval, combined with a block size limit of 1–4 MB, caps Bitcoin’s throughput at about 7 transactions per second—far below what’s needed for global-scale financial infrastructure.

These limitations are by design. Bitcoin deliberately favors decentralization and security over speed and flexibility. Its scripting language is intentionally not Turing complete, which helps minimize vulnerabilities and ensures predictable, auditable behavior. However, this also restricts programmability and limits the network’s ability to support more complex logic or higher-throughput systems natively.

As a result, Bitcoin’s Layer 1 suffers from high latency and congestion during peak demand. When the number of pending transactions outpaces block capacity, users must compete by paying higher fees for faster confirmation. This dynamic played out during key moments like the 2017 bull run, the Ordinals craze in 2023, and ETF-driven demand spikes in early 2025, with fees reaching hundreds of satoshis per virtual byte. For small or routine payments, such as remittances, microtransactions, or everyday purchases, this fee environment often renders Bitcoin impractical.

While the fee market is crucial for incentivizing miners and sustaining long-term security, it also presents a barrier to broader adoption. Bitcoin’s Layer 1 remains highly secure and decentralized but inherently constrained in scalability and programmability. These constraints have fueled the development of Layer 2 solutions aimed at unlocking faster, cheaper, and more flexible transaction models.

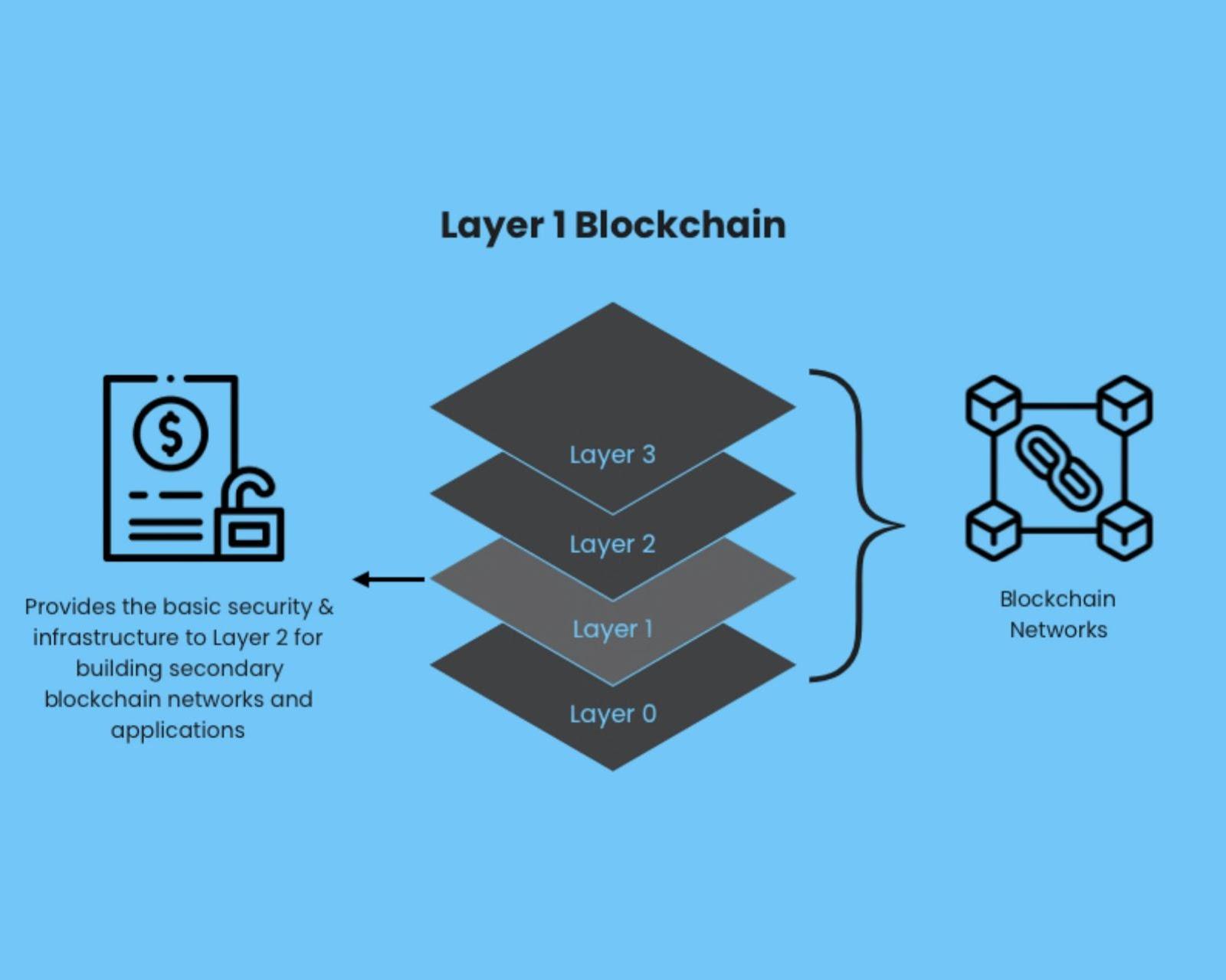

Layer-2 design patterns in blockchain architecture

Layer-2 solutions are protocols that operate on top of a base layer like Bitcoin. Their goal is to offload transactions from the main chain while still preserving Bitcoin’s settlement assurances. These systems batch, compress, or otherwise abstract away transaction data so that only minimal interaction with the base layer is required.

The Layer-2 design space in blockchain architecture generally falls into several patterns. One is the use of payment channels, which open a two-way connection between users to send multiple transactions without touching the base chain until the channel is closed. Another pattern is sidechains, which are independent blockchains that run in parallel to the main chain and rely on peg-in and peg-out mechanisms for asset transfers.

Rollups represent another category. They aggregate many transactions off-chain and submit a single compressed proof or data bundle to the base chain. Depending on how they validate transactions, rollups are categorized as optimistic or zero-knowledge. Although this design is native to Ethereum, it is now being adapted for Bitcoin through recent innovations.

A different model is federation-based systems. In these, a group of trusted entities jointly manage custody and transaction processing. This can include Chaumian eCash systems or pooled UTXO structures. These models enable user anonymity or frictionless custody at the cost of relying on a group of signers or guardians.

More recently, Bitcoin research has introduced BitVM, a method that allows arbitrary computation to be verified on Bitcoin through clever use of challenge-response logic. While still experimental, BitVM opens the possibility of bringing general-purpose execution to Bitcoin’s Layer-2 space.

Each of these patterns addresses different constraints, some improve scalability, others enhance privacy or enable programmability. What unites them is their commitment to using Bitcoin as the final settlement layer, while executing most logic elsewhere.

Security, decentralization, and scalability trade-offs

Any Layer-2 solution must carefully balance three core properties: security, decentralization, and scalability. This concept, often called the scalability trilemma, holds that optimizing for two of these properties typically requires trade-offs in the third.

Bitcoin’s base layer maximizes security and decentralization, but as a result, it sacrifices throughput. Layer-2s attempt to regain scalability while minimizing compromises to the other two. However, trade-offs are inevitable.

Payment channels like the Lightning Network inherit Bitcoin’s security model but face challenges in decentralization and routing efficiency. Channels must be funded with on-chain capital, and payments are limited to the network of connected peers. Routing liquidity is often uneven, and mobile users can face reliability issues. Moreover, the model depends on watchtowers or active monitoring to prevent fraud during disputes.

Federated systems like Fedimint trade off some decentralization in exchange for privacy and onboarding simplicity. Guardians can censor or mismanage funds, even if protocols attempt to minimize this risk through multiparty custody and community selection. Users must trust that a quorum of federation members remains honest.

Sidechains such as Liquid or Rootstock maintain programmability and scalability but shift trust to a separate validator set. These systems do not inherit Bitcoin’s proof-of-work security. Assets transferred into a sidechain are locked via a federation or smart contract, and the safety of the funds depends on the sidechain’s internal consensus.

Rollups offer better data integrity and scalability, especially with the advent of zero-knowledge proofs. But on Bitcoin, where rollups must operate without native support, developers face additional constraints. Projects like Citrea and Botanix are working to implement rollups using Taproot and other soft forks, but the lack of opcode flexibility complicates matters.

BitVM, while promising, involves novel trust and incentive models that are still under research. It opens the door to arbitrary logic execution on Bitcoin without altering its consensus rules, but at the cost of complex dispute resolution and high latency.

Each design choice involves careful engineering around these three trade-offs. Some systems lean toward speed and cost-efficiency; others prioritize censorship resistance or programmability. Users and developers must evaluate which trade-offs are acceptable for their use case.

Types of Bitcoin Layer-2s

Bitcoin’s Layer-2 ecosystem has matured significantly in recent years. What started with basic payment channels has now evolved into a multi-pronged landscape of scaling and extension tools. Each class of solution serves a different user profile and application area.

The Lightning Network is the most widely deployed Layer-2 for Bitcoin. It enables instant, low-cost payments through a network of bidirectional channels. Once a channel is open, users can route payments across multiple peers. The network is particularly suited for high-frequency, low-value transactions such as tipping, micro-purchases, and remittances. Lightning is non-custodial and trust-minimized, but its liquidity model can be complex, especially for new users and businesses.

Federated systems like Fedimint and Ark focus on privacy and simplicity. Fedimint uses a Chaumian eCash model where users deposit BTC with a trusted group of guardians who issue anonymized tokens. These tokens can be spent privately and eventually redeemed for on-chain BTC or Lightning payments. Ark, a newer design, allows anonymous one-round payments by using a host that aggregates and broadcasts transactions for many users at once. Both models offer improved privacy but depend on some degree of custodial trust or coordination.

Sidechains extend Bitcoin’s functionality by running parallel chains with different rules and execution environments. Liquid, launched by Blockstream, is a federated sidechain designed for fast, confidential asset transfers between exchanges. Rootstock brings an Ethereum-style virtual machine to Bitcoin, enabling smart contracts and decentralized apps. These systems enable more complex financial use cases but require users to trust that peg mechanisms and validator sets operate honestly.

Rollups are just beginning to appear in Bitcoin’s ecosystem. Citrea is developing a zero-knowledge rollup that uses Bitcoin for settlement while executing contracts off-chain. Botanix is building a rollup with EVM compatibility that anchors transaction data to Bitcoin blocks. These projects aim to bring the scalability benefits seen on Ethereum to Bitcoin, though they face unique technical hurdles due to Bitcoin’s conservative scripting language.

BitVM represents an emerging direction for Layer-2 development. Proposed in 2023, BitVM allows general computation to be verified on Bitcoin using an interactive fraud-proof system. By enabling Turing-complete logic through challenge-response rounds, BitVM could support complex applications such as bridges, oracles, or rollups—without requiring a hard fork. It is still experimental and has not yet been deployed at scale.